Albertsons 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

that the company will purchase upon completion. The company did not enter into any new guarantees or modify

existing guarantees after December 31, 2002.

On December 4, 1998, the company entered into an agreement to sell notes receivable to a special purpose

entity, which qualifies to be accounted for as an unconsolidated subsidiary. The entity is designed to acquire

qualifying notes receivable from the company and sell them to a third party. No notes have been sold since

February 29, 2000. Assets and related debt off-balance sheet were $13.4 million at February 22, 2003. At

February 22, 2003, the company’s limited recourse with respect to notes sold was $11.0 million.

The company is party to synthetic leasing programs for two of its major warehouses. The leases expire in

April 2003 and September 2004. The lease that expires in April 2003 has a purchase option of approximately

$60 million. The lease that expires in September 2004 may be renewed with the lessor’s consent through

September 2006, and has a purchase option of approximately $25 million. At February 22, 2003, the estimated

market value of the properties underlying these leases equaled or exceeded the purchase options.

In July and August 2002, several class action lawsuits were filed against the company and certain of its

officers and directors in the United States District Court for the District of Minnesota on behalf of purchasers of

the company’s securities between July 11, 1999 and June 26, 2002. The lawsuits have been consolidated into a

single action, in which it is alleged that the company and certain of its officers and directors violated Federal

securities laws by issuing materially false and misleading statements relating to its financial performance. The

company believes that the lawsuit is without merit and intends to vigorously defend the action. No damages have

been specified. The company is unable to evaluate the likelihood of prevailing in the case at this stage of the

proceedings.

The company is a party to various other legal proceedings arising from the normal course of business

activities, none of which, in management’s opinion, is expected to have a material adverse impact on the

company’s consolidated statement of earnings or consolidated financial position.

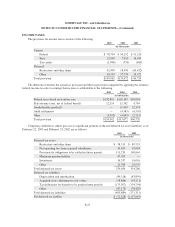

RETIREMENT PLANS

Substantially all non-union employees of the company and its subsidiaries are covered by various

contributory and non-contributory pension or profit sharing plans. The company also participates in several

multi-employer plans providing defined benefits to union employees under the provisions of collective

bargaining agreements.

Contributions under the defined contribution 401(k) and profit sharing plans are determined by plan

provisions or at the discretion of the company’s Retirement Committee and were $8.0 million, $16.1 million and

$11.9 million for fiscal 2003, 2002, and 2001, respectively. Plan assets also include 2.9 million shares and

3.1 million shares of the company’s common stock at February 22, 2003 and February 23, 2002, respectively.

Amounts charged to union pension expense were $35.2 million, $38.4 million and $42.7 million for fiscal 2003,

2002, and 2001, respectively.

Benefit calculations for the company’s defined benefit pension plans for non-union eligible participants are

generally based on years of service and the participants’ highest compensation during five consecutive years of

employment. Annual payments to the pension trust fund are determined in compliance with the Employee

Retirement Income Security Act (ERISA). Plan assets are held in trust and invested in separately managed

accounts and publicly traded mutual funds holding both equity and fixed income securities.

In addition to providing pension benefits, the company provides certain health care and life insurance

benefits for certain retired employees. Certain employees become eligible for these benefits upon meeting certain

age and service requirements.

F-31