Albertsons 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Earnings

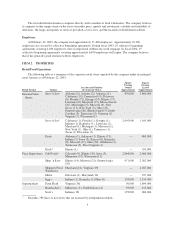

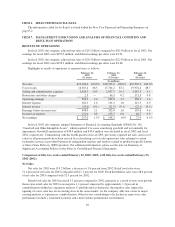

The company’s operating earnings were $504.8 million for fiscal 2002 compared to $330.4 million for

2001, a 52.8 percent increase. Fiscal 2002 operating earnings include $46.3 million for restructure and other

charges and $12.5 million in store closing reserves recorded in the fourth quarter. Fiscal 2001 operating earnings

include $171.3 million for restructure and other charges and $68.8 million primarily for store closing reserves

and provisions for certain uncollectible receivables. Retail food 2002 operating earnings increased 26.8 percent

to $363.3 million, or 3.8 percent of net sales, from 2001 operating earnings of $286.5 million, or 3.1 percent of

net sales primarily due to growth of new stores and improved merchandising execution in retail. Food

distribution 2002 operating earnings decreased 9.6 percent to $227.0 million, or 2.1 percent of net sales, from

2001 operating earnings of $251.0 million, or 1.9 percent of sales, reflecting a decrease in sales volume,

primarily due to the exit of the Kmart supply contract.

Net Interest Expense

Interest expense decreased to $194.3 million in 2002, compared with $212.9 million in 2001, reflecting

lower borrowing levels and lower average interest rates. Interest income decreased to $21.5 million in 2002

compared with $22.1 million in 2001.

Income Taxes

The effective tax rate was 40.3 percent in 2002 compared with 47.8 percent in 2001. The 2001 effective tax

rate includes the impact of restructure and other charges.

Net Earnings

Net earnings were $198.3 million, or $1.48 per diluted share, in 2002 compared with net earnings of

$72.9 million, or $0.55 per diluted share in 2001.

Weighted average diluted shares increased to 134.0 million in 2002 compared with 2001 weighted average

diluted shares of 132.8 million, reflecting the net impact of stock option activity and shares repurchased under

the treasury stock program.

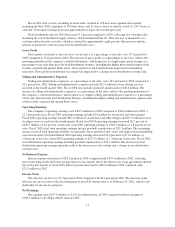

RESTRUCTURE AND OTHER CHARGES

In the fourth quarter of fiscal 2003, the company recognized pre-tax restructure and other charges of

$2.9 million reflected in the “Restructure and other charges” line in the Consolidated Statements of Earnings

primarily due to continued softening of real estate in certain markets. The charges represent the net adjustment

for changes in estimates related to prior years’ restructure reserves and asset impairment charges, including a

decrease of $3.6 million to restructure 2002, a net increase of $8.1 million to restructure 2001 and a net decrease

of $1.6 million to restructure 2000.

Restructure 2002

In the fourth quarter of fiscal 2002, the company identified additional efforts that would allow it to extend

its distribution efficiency program that began early in fiscal 2001. The additional distribution efficiency

initiatives identified resulted in pre-tax restructure charges of $16.3 million, primarily related to personnel

reductions in administrative and transportation functions. Management began the initiatives in fiscal 2003 and

the majority of these actions were completed by the end of fiscal 2003.

In the fourth quarter of fiscal 2003, the fiscal 2002 restructure charges were decreased by $3.6 million,

including a decrease of $1.4 million due to lower than anticipated lease related costs in transportation efficiency

initiatives and a decrease of $2.2 million in employee related costs due to lower than anticipated severance costs.

13