Albertsons 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

industrial revenue bonds and other variable interest rate debt) is utilized to help maintain liquidity and finance

business operations. Long-term debt with fixed interest rates is used to assist in managing debt maturities and to

diversify sources of debt capital.

The company makes long-term loans to certain retail customers (see Notes Receivable in the Notes to

Consolidated Financial Statements for further information) and as such, carries notes receivable in the normal

course of business. The notes generally bear fixed interest rates negotiated with each retail customer. The market

value of the fixed rate notes is subject to change due to fluctuations in market interest rates. At February 22,

2003, the estimated fair value of notes receivable approximates the net carrying value.

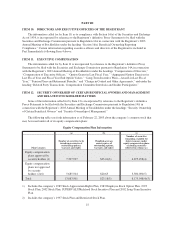

The table below provides information about the company’s financial instruments that are sensitive to

changes in interest rates, including notes receivable, debt obligations and interest rate swap agreements. For debt

obligations, the table presents principal cash flows and related weighted average interest rates by expected

maturity dates. For notes receivable, the table presents the expected collection of principal cash flows and

weighted average interest rates by expected maturity dates. For interest rate swap agreements, the table presents

the estimate of the differentials between interest payable and interest receivable under the swap agreements

implied by the yield curve utilized to compute the fair value of the interest rate swaps.

Summary of Financial Instruments

February 22, 2003 Aggregate payments by fiscal year

Fair

Value Total 2004 2005 2006 2007 2008 Thereafter

(in millions, except rates)

Notes receivable

Principal receivable $ 102.2 $ 102.2 $30.3 $ 18.1 $15.4 $12.0 $10.6 $ 15.8

Average rate receivable 7.8% 5.6% 9.3% 9.5% 9.5% 9.6% 7.9%

Debt with variable interest rates

Principal payable $ 150.5 $ 150.5 $88.0 $ — $ 2.4 $ 2.6 $ 1.0 $ 56.5

Average variable rate

payable 1.4% 1.6% — 1.2% 1.2% 1.2% 1.2%

Debt with fixed interest rates

Principal payable $1,521.6 $1,435.5 $23.2 $271.8 $60.8 $71.0 $ 4.0 $1,004.7

Average fixed rate payable 7.2% 8.3% 7.7% 7.2% 6.8% 8.5% 7.1%

Fixed-to-variable interest rate

swaps

Amount receivable $ 20.7 $ 20.7 $ 8.8 $ 6.3 $ 3.6 $ 1.8 $ 0.6 $ (0.4)

Average variable rate

payable 3.9%

Average fixed rate

receivable 7.9%

Cautionary Statements for Purposes of the Safe Harbor Provisions of the Private Securities Litigation

Reform Act of 1995

Any statements in this report regarding SUPERVALU’s outlook for its businesses and their respective

markets, such as projections of future performance, statements of management’s plans and objectives, forecasts

of market trends and other matters, are forward-looking statements based on management’s assumptions and

beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,”

“will continue,” “outlook,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions.

Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to

differ materially from those discussed in such forward-looking statements and no assurance can be given that the

25