Albertsons 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

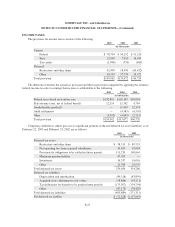

DEBT

February 22,

2003

February 23,

2002

(In thousands)

7.875% promissory note due fiscal 2010 $ 350,000 $ 350,000

7.5% promissory note due fiscal 2013 300,000 —

7.625% promissory note due fiscal 2005 250,000 250,000

8.875% promissory note due fiscal 2023 100,000 100,000

Zero-coupon convertible debentures 226,152 216,345

6.23%-6.69% medium-term notes due fiscal 2006-2007 103,500 103,500

7.8% promissory note due fiscal 2003 — 300,000

9.75% senior notes — 174,098

Variable rate to 7.125% industrial revenue bonds 70,530 71,530

8.28%-9.96% promissory notes due fiscal 2004-2010 26,675 32,420

7.78%, 8.02% and 8.57% obligations with quarterly payments of principal

and interest due fiscal 2005 through 2007 47,134 59,845

Other debt 32,062 10,956

1,506,053 1,668,694

Less current maturities 31,124 326,266

Long-term debt $1,474,929 $1,342,428

Aggregate maturities of long-term debt during the next five fiscal years are:

(In thousands)

2004 $ 31,124

2005 271,843

2006 63,218

2007 73,568

2008 5,059

The debt agreements contain various financial covenants including maximum permitted leverage, minimum

net worth, minimum coverage and asset coverage ratios as defined in the company’s debt agreements. The

company has met the financial covenants under the debt agreements as of February 22, 2003.

In May 2002, the company completed the issuance of the $300.0 million 10-year 7.50% Senior Notes. A

portion of the proceeds was used to redeem the company’s 9.75% Senior Notes due fiscal 2005 on June 17, 2002.

In November 2002, the company also retired a $300.0 million 7.8% note that matured.

In August 2002, the company renewed its annual accounts receivable securitization program, under which

the company can borrow up to $200.0 million on a revolving basis, with borrowings secured by eligible accounts

receivable. Outstanding borrowings under this program at February 22, 2003 and February 23, 2002, were

$80.0 million and $0, respectively, and are reflected in Notes payable in the Consolidated Balance Sheets. As of

February 22, 2003 there was $264.4 million of accounts receivable pledged as collateral. The average short-term

interest rate on the outstanding borrowings was 1.76% for fiscal 2003.

In April 2002, the company finalized a new three-year, unsecured $650.0 million revolving credit agreement

with rates tied to LIBOR plus 0.650 to 1.400 percent, based on the company’s credit ratings. The agreement

F-23