Albertsons 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

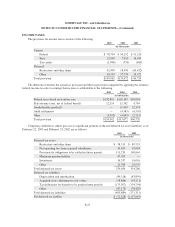

FINANCIAL INSTRUMENTS

Interest Rate Swap Agreements

On February 25, 2001, the effective date of SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities”, the company’s existing interest rate swap agreements were recorded at fair value in the

company’s Consolidated Balance Sheets. On July 6, 2001, the swaps were terminated and the remaining fair

market value adjustments, which are offsetting, are being amortized over the original term of the hedge.

Approximately $0.3 million of after-tax loss is expected to be amortized into the Consolidated Statements of

Earnings from Accumulated Other Comprehensive Losses within the next 12 months.

In the first quarter of fiscal 2003, the company entered into swap agreements in the notional amount of

$225.0 million that exchange a fixed interest rate payment obligation for a floating interest rate payment

obligation. The swaps have been designated as a fair value hedge on long-term fixed rate debt of the company

and are reflected in “Other assets” in the Consolidated Balance Sheets. At February 22, 2003, the hedge was

highly effective. Changes in the fair value of the swaps and debt are reflected as a component of selling and

administrative expense in the Consolidated Statements of Earnings, and through February 22, 2003, the net

earnings impact was zero.

The company has limited involvement with derivative financial instruments and uses them only to manage

well-defined interest rate risks. The company does not use financial instruments or derivatives for any trading or

other speculative purposes.

For certain of the company’s financial instruments, including cash and cash equivalents, receivables and

notes payable, the carrying amounts approximate fair value due to their short maturities.

Fair Value Disclosures of Financial Instruments

The estimated fair value of notes receivable approximates the net carrying value at February 22, 2003 and

February 23, 2002. Notes receivable are valued based on comparisons to publicly traded debt instruments of

similar credit quality.

The estimated fair value of the company’s long-term debt (including current maturities) was in excess of the

carrying value by approximately $86.1 million and $64.0 million at February 22, 2003 and February 23, 2002,

respectively. The estimated fair value was based on market quotes, where available, discounted cash flows and

market yields for similar instruments.

The estimated fair value of the company’s interest rate swaps approximates the carrying value at

February 22, 2003. The fair value of interest rate swaps are the amounts at which they could be settled and are

estimated by obtaining quotes from brokers.

F-22