Albertsons 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The company currently has net operating loss (NOL) carryforwards from acquired companies of

$91.2 million for tax purposes, which expire beginning in 2007 and continuing through 2018.

Temporary differences attributable to obligations to be settled in future periods consist primarily of accrued

postretirement benefits, vacation pay and other expenses that are not deductible for income tax purposes until

paid.

Based on management’s assessment, it is more likely than not that all of the deferred tax assets will be

realized; therefore, no valuation allowance is considered necessary.

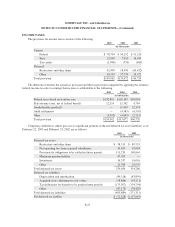

ACCUMULATED OTHER COMPREHENSIVE LOSSES

The accumulated balances, net of deferred taxes, for each classification of accumulated other

comprehensive losses are as follows:

Derivative Financial

Instrument -

Unrealized Loss

Minimum Pension

Liability Adjustment

Accumulated Other

Comprehensive Losses

(In thousands)

Balances at February 23, 2002 $(7,075) $ — $ (7,075)

Minimum pension liability — (72,328) (72,328)

Amortization of loss on

derivative financial instrument 340 — 340

Balances at February 22, 2003 $(6,735) $(72,328) $(79,063)

STOCK OPTION PLANS

The company’s 2002, 1993 and SUPERVALU/Richfood 1996 stock option plans allow the granting of non-

qualified stock options and incentive stock options to purchase shares of the company’s common stock, to key

salaried employees at prices not less than 100 percent of their fair market value, determined based on the average

of the opening and closing sale price of a share on the date of grant. The company’s 1997 stock plan allows only

the granting of non-qualified stock options to purchase common shares to salaried employees at fair market value

determined on the same basis. In April 2002, the Board of Directors reserved an additional 3.8 million shares for

issuance under the 1997 plan. The company also has options outstanding under its 1983 plan, but no further

options may be granted under that plan. The plans provide that the Board of Directors or the Executive Personnel

and Compensation Committee of the Board (the Committee) may determine at the time of granting whether each

option granted, except those granted under the 1997 plan, will be a non-qualified or incentive stock option under

the Internal Revenue Code. The terms of each option will be determined by the Board of Directors or the

Committee, but shall not be for more than 10 years from the date of grant, generally with a vesting period of zero

to four years. Options may be exercised in installments or otherwise, as the Board of Directors or the Committee,

may determine.

F-28