Albertsons 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

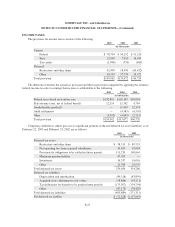

In the following table, the company has adjusted reported net earnings, diluted net earnings per common

share and basic net earnings per common share to exclude amortization expense related to goodwill, that is no

longer being amortized upon the adoption of SFAS No. 142:

(In thousands, except per share data) 2003 2002 2001

Reported net earnings $257,042 $198,326 $ 72,870

Goodwill amortization — 48,363 49,405

Adjusted net earnings $257,042 $246,689 $122,275

Diluted net earnings per common share:

Reported net earnings $ 1.91 $ 1.48 $ 0.55

Goodwill amortization — 0.35 0.37

Adjusted net earnings $ 1.91 $ 1.83 $ 0.92

Basic net earnings per common share:

Reported net earnings $ 1.92 $ 1.49 $ 0.55

Goodwill amortization — 0.35 0.37

Adjusted net earnings $ 1.92 $ 1.84 $ 0.92

The carrying amount of other intangible assets as of February 22, 2003 and February 23, 2002 are as

follows:

Balance

February 22, 2003

Balance

February 23, 2002

(In thousands)

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Non-compete agreements $ 8,506 $(4,376) $4,130 $ 8,406 $(3,500) $4,906

Customer lists and other 8,370 (4,313) 4,057 8,180 (3,914) 4,266

Total $16,876 $(8,689) $8,187 $16,586 $(7,414) $9,172

Other intangible assets are presented in the “Other assets” line in the Consolidated Balance Sheets.

Amortization expense of $1.4 million, $1.8 million and $2.4 million was recorded in the fiscal 2003, 2002 and

2001, respectively. Future amortization expense will approximate $1.0 million per year for each of the next five

years. Intangible assets with a definite life are amortized on a straight-line basis with estimated useful lives

ranging from five to ten years.

INVESTMENTS IN UNCONSOLIDATED EQUITY AFFILIATES

The company recognized $39.7 million, $29.2 million and $21.5 million in earnings from investments in

unconsolidated equity affiliates in fiscal 2003, 2002 and 2001, respectively. The equity method of accounting is

used for companies and other investments in which the company has significant influence, which generally

represents common stock ownership or partnership equity of at least 20% and not more than 50%. At year-end

2003, the company’s investment in unconsolidated equity affiliates primarily include a 22% interest in WinCo

Foods and Subsidiaries, the owner and operator of retail supermarkets located in Oregon, Washington, California

and Nevada, a 26% interest in International Data, LLC, a strategic outsourcing services provider, specializing in,

among other things, data services, check and remittance processing and coupon promotions processing and a

40% interest in Tidyman’s, LLC, the owner and operator of retail supermarkets located in Montana, Idaho and

Washington. These investments primarily relate to the retail food segment.

F-21