Albertsons 2003 Annual Report Download - page 17

Download and view the complete annual report

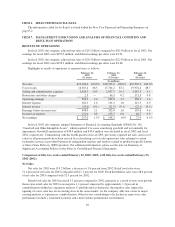

Please find page 17 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING POLICIES

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Significant accounting policies are discussed in the Summary of Significant Accounting Policies in the

Notes to Consolidated Financial Statements. Management believes the following critical accounting policies

reflect its more subjective or complex judgments and estimates used in the preparation of the company’s

consolidated financial statements.

LIFO and Retail Inventory Method

For a significant portion of the company’s inventory, cost is determined through use of the last-in, first-out

(LIFO) method for food distribution or the retail LIFO method, as applicable. Under the retail LIFO method,

otherwise referred to as the retail inventory method (RIM), the valuation of inventories are at cost and the

resulting gross margins are calculated by applying a calculated cost-to-retail ratio to the retail value of

inventories. RIM is an averaging method that has been widely used in the retail industry due to its practicality.

Inherent in the RIM calculations are certain significant management judgments and estimates, including

shrinkage, which significantly impact the ending inventory valuation at cost, as well as the resulting gross

margins. These judgments and estimates, coupled with the fact that the RIM is an averaging process, can, under

certain circumstances, produce results which differ from actual. Management believes that the company’s RIM

provides an inventory valuation which reasonably approximates cost and results in carrying inventory at the

lower of cost or market.

Allowances for Losses on Receivables

Management makes estimates of the uncollectibility of its accounts and notes receivable portfolios. In

determining the adequacy of the allowances, management analyzes the value of the collateral, customer financial

statements, historical collection experience, aging of receivables and other economic and industry factors.

Although risk management practices and methodologies are utilized to determine the adequacy of the allowance,

it is possible that the accuracy of the estimation process could be materially impacted by different judgments as

to collectibility based on the information considered and further deterioration of accounts.

Reserves for Closed Properties and Asset Impairment

The company maintains reserves for estimated losses on retail stores, distribution warehouses and other

properties that are no longer being utilized in current operations. Calculating the estimated losses requires

significant judgments and estimates to be made by management. The company’s reserves for closed properties

could be materially affected by factors such as the extent of interested buyers, its ability to secure subleases, the

creditworthiness of sublessees and the company’s success at negotiating early termination agreements with

lessors. These factors are significantly dependent on the general health of the economy and resultant demand for

commercial property. While management believes the current estimates of reserves on closed properties are

adequate, it is possible that continued weakness in the real estate market could cause changes in the company’s

assumptions and may require additional reserves to be recorded.

Impairment charges of long-lived assets are recognized when expected net future cash flows are less than

the assets’ carrying value. The company estimates net future cash flows based on its experience and knowledge

of the market in which the closed property is located and, when necessary, utilizes local real estate brokers. It is

management’s intention to dispose of properties or sublease within one year; however, the expectations on timing

of disposition or sublease and the estimated sales price or sublease income are impacted by variable factors such

as inflation, the general health of the economy and resultant demand for commercial property and may require

additional reserves to be recorded.

17