Albertsons 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

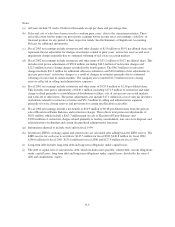

SUPERVALU INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

February 22,

2003

(52 weeks)

February 23,

2002

(52 weeks)

February 24,

2001

(52 weeks)

Cash flows from operating activities

Net earnings $ 257,042 $ 198,326 $ 72,870

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation and amortization 297,056 340,750 343,779

LIFO expense 4,741 143 4,991

Provision for losses on receivables 15,719 19,898 23,107

(Gain) loss on sale of property, plant and equipment (5,564) 4,649 (1,164)

Restructure and other charges 2,918 46,300 171,264

Deferred income taxes 14,184 76,360 (38,480)

Equity in earnings of unconsolidated subsidiaries (39,724) (29,156) (21,526)

Other adjustments, net 3,675 (1,228) (3,496)

Changes in assets and liabilities

Receivables (46,890) 120,613 (66,482)

Inventories (15,974) 298,150 130,657

Accounts payable 97,783 (386,504) (13,845)

Other assets and liabilities (11,390) 4,241 10,129

Net cash provided by operating activities 573,576 692,542 611,804

Cash flows from investing activities

Additions to long-term notes receivable (61,963) (37,372) (69,875)

Proceeds received on long-term notes receivable 57,869 47,794 66,572

Proceeds from sale of assets 65,986 57,798 43,839

Purchases of property, plant and equipment (382,581) (292,927) (397,715)

Net cash used in investing activities (320,689) (224,707) (357,179)

Cash flows from financing activities

Net issuance (reduction) of notes payable 56,000 (551,574) 2,526

Proceeds from issuance of long-term debt 296,535 218,014 60,000

Repayment of long-term debt (472,448) (19,863) (171,692)

Reduction of obligations under capital leases (29,767) (25,988) (28,220)

Dividends paid (75,648) (74,024) (72,244)

Net proceeds from the sale of common stock under option plans 31,617 19,458 3,085

Payment for purchase of treasury shares (42,159) (32,083) (48,604)

Net cash used in financing activities (235,870) (466,060) (255,149)

Net increase (decrease) in cash and cash equivalents 17,017 1,775 (524)

Cash and cash equivalents at beginning of year 12,171 10,396 10,920

Cash and cash equivalents at end of year $ 29,188 $ 12,171 $ 10,396

SUPPLEMENTAL CASH FLOW INFORMATION

The company’s non-cash activities were as follows:

Leased asset additions and related obligations $ 42,829 $ 95,730 $ 113,958

Minimum pension liability, net of deferred taxes of $47.1 million $ 72,328 $ — $ —

Interest and income taxes paid:

Interest paid (net of amount capitalized) $ 171,089 $ 184,719 $ 213,572

Income taxes paid $ 84,674 $ 102,123 $ 75,266

See notes to consolidated financial statements.

F-9