Albertsons 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

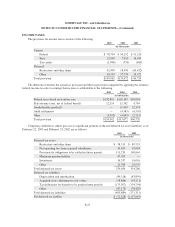

INCOME TAXES

The provision for income taxes consists of the following:

2003 2002 2001

(In thousands)

Current

Federal $ 78,704 $ 50,152 $ 91,126

State 12,050 7,910 14,674

Tax credits (1,000) (750) (600)

Deferred

Restructure and other items 31,009 18,590 (63,452)

Other 30,199 57,770 24,972

Total provision $150,962 $133,672 $ 66,720

The difference between the actual tax provision and the tax provision computed by applying the statutory

federal income tax rate to earnings before taxes is attributable to the following:

2003 2002 2001

(In thousands)

Federal taxes based on statutory rate $142,801 $116,199 $48,856

State income taxes, net of federal benefit 12,153 11,562 4,764

Nondeductible goodwill — 15,439 22,354

Audit settlements — (4,583) (6,539)

Other (3,992) (4,945) (2,715)

Total provision $150,962 $133,672 $66,720

Temporary differences which give rise to significant portions of the net deferred tax asset (liability) as of

February 22, 2003 and February 23, 2002 are as follows:

2003 2002

(In thousands)

Deferred tax assets:

Restructure and other items $ 58,515 $ 89,524

Net operating loss from acquired subsidiaries 35,853 42,083

Provision for obligations to be settled in future periods 151,233 140,664

Minimum pension liability 47,025 —

Inventories 16,247 16,016

Other 25,783 25,979

Total deferred tax assets 334,656 314,266

Deferred tax liabilities:

Depreciation and amortization (84,318) (83,899)

Acquired assets adjustment to fair values (58,886) (54,211)

Tax deductions for benefits to be paid in future periods (175,507) (154,794)

Other (87,173) (78,407)

Total deferred tax liabilities (405,884) (371,311)

Net deferred tax liability $ (71,228) $ (57,045)

F-27