Albertsons 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EITF Issue No. 02-16, “Accounting by a Reseller for Cash Consideration Received from a Vendor”,

addresses how a reseller of a vendor’s products should account for cash consideration received from a vendor and

how to measure that consideration in its income statement. Certain provisions of EITF No. 02-16 were effective

November 22, 2002 and other provisions were effective after December 31, 2002. This EITF did not have a

material impact on the company’s consolidated financial statements.

EITF Issue No. 02-17, “Recognition of Customer Relationship Intangible Assets Acquired in a Business

Combination”, focuses on customer relationship assets. EITF No. 02-17 addresses the contractual or other legal

criteria that must be met for determining the fair value of intangible assets apart from goodwill, even if the

contract does not exist at the date of the acquisition. EITF No. 02-17 is effective for business combinations

consummated and goodwill impairment tests performed after October 25, 2002. This EITF did not have a

material impact on the company’s consolidated financial statements.

Statement of Position (SOP) No. 01-06, “Accounting by Certain Entities (Including Entities with Trade

Receivables) that Lend to or Finance the Activities of Others”, became effective for the company on February 24,

2002. SOP No. 01-06 addresses the appropriate accounting for a company’s financing and lending activities.

SOP No. 01-06 did not have a material impact on the company’s consolidated financial statements.

Recently Issued Accounting Standards

In June 2001, the FASB issued SFAS No. 143, “Accounting for Asset Retirement Obligations”, which

addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived

assets and the associated asset retirement costs. The company plans to adopt the provisions of SFAS No. 143 in

the first quarter of fiscal 2004. The company does not expect the adoption of SFAS No. 143 to have a material

impact on its consolidated financial statements.

In April 2002, the FASB issued SFAS No. 145, “Recission of FASB Statements No. 4, 44 and 64,

Amendment of FASB Statement No. 13, and Technical Corrections”. SFAS No. 145 allows only those gains and

losses on the extinguishment of debt that meet the criteria of extraordinary items to be treated as such in the

financial statements. SFAS No. 145 also requires sales-leaseback accounting for certain lease modifications that

have economic effects that are similar to sales-leaseback transactions. Certain provisions of SFAS No. 145 are

effective for transactions occurring after May 15, 2002, while the remaining provisions will be effective for the

company in the first quarter of fiscal 2004. The company does not expect the adoption of SFAS No. 145 to have

a material impact on its consolidated financial statements.

In January 2003, the FASB issued FIN No. 46, “Consolidation of Variable Interest Entities”. FIN No. 46

states that companies that have exposure to the economic risks and potential rewards from another entity’s assets

and activities have a controlling financial interest in a variable interest entity and should consolidate the entity,

despite the absence of clear control through a voting equity interest. The consolidation requirements apply to all

variable interest entities created after January 31, 2003. For variable interest entities that existed prior to

February 1, 2003, the consolidation requirements are effective for annual or interim periods beginning after

June 15, 2003. Disclosure of significant variable interest entities is required in all financial statements issued

after January 31, 2003, regardless of when the variable interest was created. The company does not expect the

adoption of FIN No. 46 to have a material impact on its consolidated financial statements.

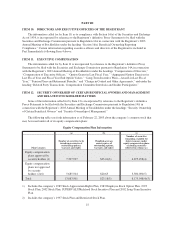

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The company is exposed to market pricing risk consisting of interest rate risk related to debt obligations

outstanding, its investment in notes receivable and, from time to time, derivatives employed to hedge interest rate

changes on variable and fixed rate debt. The company does not use financial instruments or derivatives for any

trading or other speculative purposes.

The company manages interest rate risk through the strategic use of fixed and variable rate debt and, to a

limited extent, derivative financial instruments. Variable interest rate debt (commercial paper, bank loans,

24