Albertsons 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

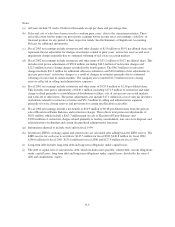

SUPERVALU INC. and Subsidiaries

CONSOLIDATED COMPOSITION OF NET SALES AND OPERATING EARNINGS

(In thousands, except percent data)

February 22, 2003

(52 weeks)

February 23, 2002

(52 weeks)

February 24, 2001

(52 weeks)

Net sales

Retail food $ 9,848,230 $ 9,549,068 $ 9,353,992

51.4% 47.1% 41.5%

Food distribution 9,312,138 10,743,972 13,166,392

48.6% 52.9% 58.5%

Total net sales $19,160,368 $20,293,040 $22,520,384

100.0% 100.0% 100.0%

Operating earnings

Retail food operating earnings $ 436,537 $ 363,304 $ 286,520

Food distribution operating earnings 171,589 227,013 251,009

General corporate expenses (35,265) (39,245) (35,840)

Restructure and other charges (2,918) (46,300) (171,264)

Total operating earnings 569,943 504,772 330,425

Interest expense, net (161,939) (172,774) (190,835)

Earnings before income taxes $ 408,004 $ 331,998 $ 139,590

Identifiable assets

Retail food $ 3,352,164 $ 3,098,577 $ 3,082,088

Food distribution 2,527,858 2,683,486 3,247,172

Corporate 16,223 14,186 13,892

Total $ 5,896,245 $ 5,796,249 $ 6,343,152

Depreciation and amortization

Retail food $ 167,143 $ 177,585 $ 173,418

Food distribution 127,042 160,718 167,253

Corporate 2,871 2,447 3,108

Total $ 297,056 $ 340,750 $ 343,779

Capital expenditures

Retail food $ 357,342 $ 310,738 $ 347,540

Food distribution 80,916 74,860 158,591

Corporate 1,180 3,060 5,542

Total $ 439,438 $ 388,658 $ 511,673

The company’s business is classified by management into two reportable segments: Retail food and food

distribution. Retail food operations include three retail formats: extreme value stores, regional price superstores

and regional supermarkets. The retail formats include results of food stores owned and results of sales to extreme

value stores licensed by the company. Food distribution operations include results of sales to affiliated food

stores, mass merchants and other customers, and other logistics arrangements. Management utilizes more than

one measurement and multiple views of data to assess segment performance and to allocate resources to the

segments. However, the dominant measurements are consistent with the consolidated financial statements.

Reportable segment operating earnings were computed as total revenue less associated operating expenses.

Fiscal 2002 operating earnings reflect pretax charges of $12.5 million in retail food for store closing reserves.

Fiscal 2001 operating earnings reflect pretax charges of $44.5 million in retail food for store closing reserves and

$24.3 million in food distribution for inventory markdowns and provisions for certain uncollectible receivables.

Identifiable assets are those assets of the company directly associated with the reportable segments.

See notes to consolidated financial statements.

F-5