Albertsons 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 6. SELECTED FINANCIAL DATA

The information called for by Item 6 is found within the Five Year Financial and Operating Summary on

page F-2.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

In fiscal 2003, the company achieved net sales of $19.2 billion compared to $20.3 billion in fiscal 2002. Net

earnings for fiscal 2003 were $257.0 million, and diluted earnings per share were $1.91.

In fiscal 2002, the company achieved net sales of $20.3 billion compared to $22.5 billion in fiscal 2001. Net

earnings for fiscal 2002 were $198.3 million, and diluted earnings per share were $1.48.

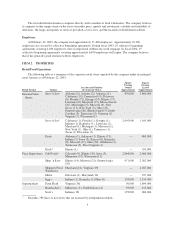

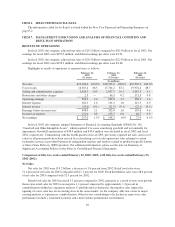

Highlights of results of operations as reported were as follows:

February 22,

2003

(52 weeks)

February 23,

2002

(52 weeks)

February 24,

2001

(52 weeks)

(In millions)

Net sales $19,160.4 100.0% $20,293.0 100.0% $22,520.4 100.0%

Cost of sales 16,567.4 86.5 17,704.2 87.2 19,976.4 88.7

Selling and administrative expenses 2,020.2 10.5 2,037.7 10.1 2,042.3 9.1

Restructure and other charges 2.9 — 46.3 0.2 171.3 0.8

Operating earnings 569.9 3.0 504.8 2.5 330.4 1.4

Interest expense 182.5 1.0 194.3 1.0 212.9 0.9

Interest income (20.6) (0.1) (21.5) (0.1) (22.1) (0.1)

Earnings before income taxes 408.0 2.1 332.0 1.6 139.6 0.6

Income tax expense 151.0 0.8 133.7 0.6 66.7 0.3

Net earnings $ 257.0 1.3% $ 198.3 1.0% $ 72.9 0.3%

In fiscal 2003, the company adopted Statement of Financial Accounting Standards (SFAS) No. 142,

“Goodwill and Other Intangible Assets”, which required it to cease amortizing goodwill and test annually for

impairment. Goodwill amortization of $48.4 million and $49.4 million were included in fiscal 2002 and fiscal

2001, respectively. Commencing with the fourth quarter of fiscal 2003, previously reported net sales and cost of

sales for all prior periods have been revised by reclassifying cost of sales against net sales relating to certain

facilitative services it provided between its independent retailers and vendors related to products typically known

as Direct Store Delivery (DSD) products. For additional information, please see the note on Summary of

Significant Accounting Policies in the Notes to Consolidated Financial Statements.

Comparison of fifty-two weeks ended February 22, 2003 (2003) with fifty-two weeks ended February 23,

2002 (2002):

Net Sales

Net sales for 2003 were $19.2 billion, a decrease of 5.6 percent from 2002. Retail food sales were

51.4 percent of net sales for 2003 compared with 47.1 percent for 2002. Food distribution sales were 48.6 percent

of net sales for 2003 compared with 52.9 percent for 2002.

Retail food sales for 2003 increased 3.1 percent compared to 2002, primarily as a result of new store growth.

Same-store retail sales for 2003 were negative 1.1 percent, impacted by approximately 1.2 percent in

cannibalization within key expansion markets. Cannibalization is defined as the negative sales impact the

opening of a new store has on an existing store in the same market. As the company adds new stores to major

existing markets, it experiences cannibalization. Other factors contributing to the decline in same store sales

performance include a weakened economy and a more intense promotional environment.

10