Albertsons 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

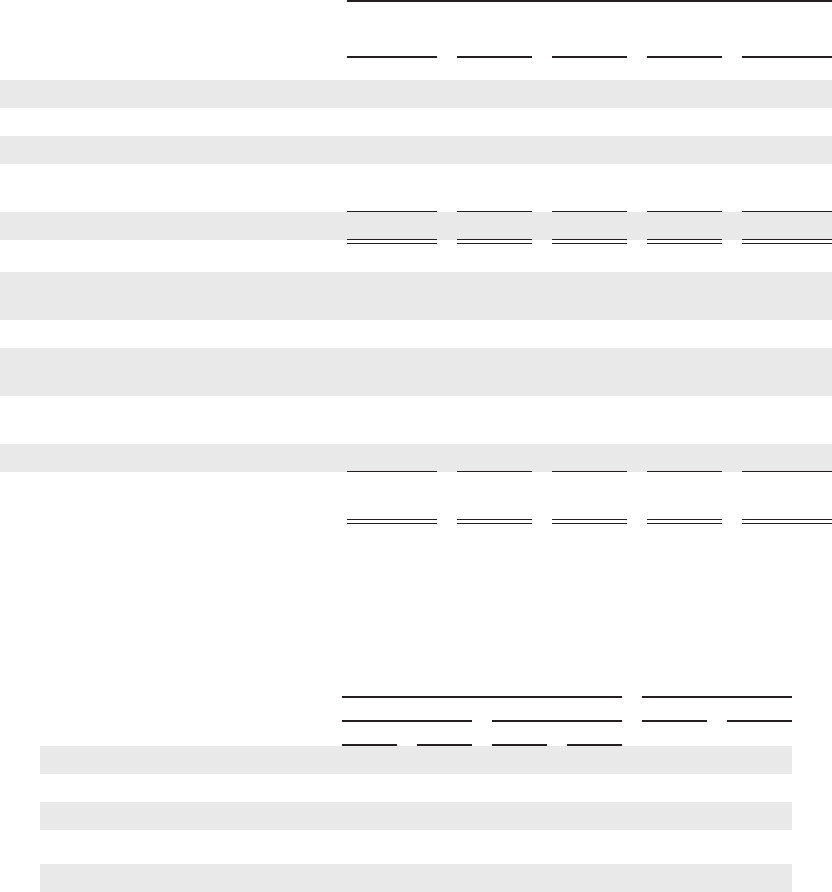

The following table represents the company’s total commitments and total off-balance sheet arrangements at

February 22, 2003:

Amount of Commitment Expiration Per Period

Total

Amount

Committed

Fiscal

2004

Fiscal

2005-2006

Fiscal

2007-2008 Thereafter

(in thousands)

Commitments:

Notes Payable $ 80,000 $ 80,000 $ — $ — $ —

Debt 1,506,053 31,124 335,061 78,627 1,061,241

Capital and Direct Financing

Leases 575,185 30,456 89,637 86,562 368,530

Total Commitments $2,161,238 $141,580 $424,698 $165,189 $1,429,771

Off-Balance Sheet Arrangements:

Retailer Loan and Lease

Guarantees $ 305,946 $ 46,758 $ 71,691 $ 49,186 $ 138,311

Construction Loan Commitments 26,300 26,300 — — —

Limited Recourse Liability on

Notes Receivable 10,969 523 5,123 5,323 —

Purchase Options on Synthetic

Leases 85,000 60,000 — 25,000 —

Operating Leases 1,007,170 141,612 235,662 179,335 450,561

Total Off-Balance Sheet

Arrangements $1,435,385 $275,193 $312,476 $258,844 $ 588,872

COMMON STOCK PRICE

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal

2003 year end, there were 6,960 shareholders of record compared with 7,155 at the end of fiscal 2002.

Common Stock Price Range Dividends Per Share

Fiscal

2003 2002 2003 2002

High Low High Low

First Quarter $30.81 $24.60 $16.46 $12.60 $0.1400 $0.1375

Second Quarter 28.94 19.18 21.80 15.00 0.1425 0.1400

Third Quarter 21.59 14.75 24.10 18.81 0.1425 0.1400

Fourth Quarter 18.12 14.01 24.96 18.85 0.1425 0.1400

Year $30.81 $14.01 $24.96 $12.60 $0.5675 $0.5575

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to

the Board of Directors approval.

NEW ACCOUNTING STANDARDS

Recently Adopted Accounting Standards

In June 2001, the Financial Accounting Standards Board (FASB) approved SFAS No. 142. SFAS No. 142

requires companies to cease amortizing goodwill and test at least annually for impairment. Amortization of

goodwill ceased on February 24, 2002, at which time goodwill was tested for impairment. Each of the company’s

22