Albertsons 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

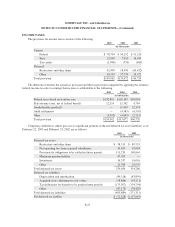

Changes in the options granted, exercised and outstanding under such plans are as follows:

Shares

Weighted

Average

Price per

Share

(In thousands)

Outstanding, February 26, 2000 11,742 $22.01

Granted 4,243 15.15

Exercised (509) 15.72

Canceled and forfeited (1,066)

Outstanding, February 24, 2001 14,410 $20.26

Granted 1,215 17.32

Exercised (1,781) 15.82

Canceled and forfeited (677)

Outstanding, February 23, 2002 13,167 $20.69

Granted 2,885 28.27

Exercised (2,896) 17.44

Canceled and forfeited (151)

Outstanding, February 22, 2003 13,005 $23.10

The outstanding stock options at February 22, 2003 have exercise prices ranging from $12.25 to $40.00 per

share and a weighted average remaining contractual life of 6.09 years. Options to purchase 7.9 million and

8.3 million shares were exercisable at February 22, 2003 and February 23, 2002, respectively. These options have

a weighted average exercise price of $20.89 and $19.11 per share, respectively. Option shares available for grant

were 7.3 million and 1.9 million at February 22, 2003 and February 23, 2002, respectively. The company has

reserved 20.3 million shares, in aggregate, for the plans.

As of February 22, 2003, limited stock appreciation rights have been granted and are outstanding under the

1989 stock appreciation rights plan and the 1993 stock plan. Such rights relate to options granted to purchase

2.1 million shares of common stock and are exercisable only upon a “change in control.”

In addition to the stock plans described above, the company incurs expenses under both a long-term

incentive plan and restricted stock plans at the discretion of the Board of Directors. Compensation expense under

these plans was $4.1 million, $4.7 million and $1.0 million for fiscal 2003, 2002 and 2001, respectively.

See Summary of Significant Accounting Policies in the Notes to Consolidated Financial Statements for the

impact of stock based compensation on pro forma net earnings and earnings per common share.

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

model with the following weighted-average assumptions and results:

2003 2002 2001

Dividend yield 2.00% 2.00% 2.00%

Risk free interest rate 2.86% 4.23% 4.83%

Expected life 4.5 years 4.5 years 5 years

Expected volatility 34.66% 32.50% 30.40%

Estimated fair value of options granted per share $ 7.77 $ 4.85 $ 4.37

F-29