Albertsons 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The company has only limited involvement with derivative financial instruments and uses them only to

manage well-defined interest rate risks. The derivatives used have included interest rate caps, collars and swap

agreements. The company does not use financial instruments or derivatives for any trading or other speculative

purposes.

Stock-based Compensation:

The company has stock based employee compensation plans, which are described more fully in the Stock

Option Plans note in the Notes to Consolidated Financial Statements. The company utilizes the intrinsic value-

based method, per APB Opinion No. 25, “Accounting for Stock Issued to Employees,” for measuring the cost of

compensation paid in company common stock. This method defines the company’s cost as the excess of the

stock’s market value at the time of the grant over the amount that the employee is required to pay. In accordance

with APB Opinion No. 25, no compensation expense was recognized for options issued under the stock option

plans in fiscal 2003, 2002 and 2001 as the exercise price of all options granted was not less than 100 percent of

fair market value of the common stock on the date of grant.

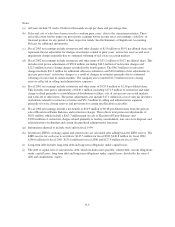

The following table illustrates the effect on net earnings and net earnings per common share if the company

had applied the fair value recognition provisions of SFAS No. 123, “Accounting for Stock Based Compensation”

to stock-based employee compensation:

2003 2002 2001

(In thousands, except per share data)

Net earnings, as reported $257,042 $198,326 $72,870

Deduct: total stock-based employee compensation expense determined under

fair value based method for all awards, net of related tax effect (9,528) (5,501) (7,894)

Pro forma net earnings $247,514 $192,825 $64,976

Earnings per share—basic:

As reported $ 1.92 $ 1.49 $ 0.55

Pro forma $ 1.85 $ 1.45 $ 0.49

Earnings per share—diluted:

As reported $ 1.91 $ 1.48 $ 0.55

Pro forma $ 1.84 $ 1.44 $ 0.49

Income Taxes:

The company provides for deferred income taxes during the year in accordance with SFAS No. 109,

“Accounting for Income Taxes”. Deferred income taxes represent future net tax effects resulting from temporary

differences between the financial statement and tax basis of assets and liabilities using enacted tax rates in effect

for the year in which the differences are expected to be settled or realized. The major temporary differences and

their net effect are shown in the Income Taxes note in the Notes to Consolidated Financial Statements.

Net Earnings Per Share (EPS):

EPS is calculated using income available to common shareholders divided by the weighted average of

common shares outstanding during the year. Diluted EPS is similar to basic EPS except that the weighted

average of common shares outstanding is increased to include the number of additional common shares that

would have been outstanding if the dilutive potential common shares, such as options, had been exercised.

F-13