Albertsons 2003 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2003 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

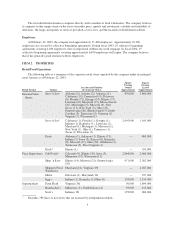

ITEM 1. BUSINESS

General Development

SUPERVALU is one of the largest companies in the United States grocery channel. SUPERVALU conducts

its retail operations under three principal store formats: extreme value stores under the retail banners Save-A-Lot

and Deal$ – Nothing Over A Dollar (Deals) general merchandise stores; regional price superstores, under such

regional retail banners as Cub Foods, Shop ’n Save, Shoppers Food Warehouse, Metro and bigg’s; and regional

supermarkets, under such regional retail banners as Farm Fresh, Scott’s and Hornbacher’s. SUPERVALU also

provides food distribution and related logistics support services across the United States retail grocery channel.

As of the close of the fiscal year, the company conducted its retail operations through 1,417 retail stores,

including 783 licensed extreme value stores. In addition, as of the close of the fiscal year, the company was

affiliated with 3,960 retail food stores in 48 states as the primary supplier of approximately 2,460 stores and a

secondary supplier of approximately 1,500 stores.

SUPERVALU’s plans include focused retail growth through targeted new store development, licensee

growth and acquisitions. During fiscal 2003, the company added 157 net new stores through new store

development and acquisitions, including the acquisition of 50 Deals stores. The company’s plans also include

growing its distribution operations by providing logistic and service solutions through an efficient supply chain,

which will allow it to affiliate new customers, participate in the consolidation of the food distribution industry

and become a logistics provider to third parties.

SUPERVALU INC., a Delaware corporation, was organized in 1925 as the successor to two wholesale

grocery firms established in the 1870’s. The company’s principal executive offices are located at 11840 Valley

View Road, Eden Prairie, Minnesota 55344 (Telephone: 952-828-4000). Unless the discussion in this Annual

Report on Form 10-K indicates otherwise, all references to the “company,” “SUPERVALU” or “Registrant”

relate to SUPERVALU INC. and its majority-owned subsidiaries.

The company makes available free of charge at its internet website (www.supervalu.com) its annual reports

on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these

reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as

reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange

Commission. Information on the company’s website is not deemed to be incorporated by reference into this

Annual Report on Form 10-K.

The company will also provide its SEC filings free of charge upon written request to the Corporate

Secretary, SUPERVALU INC., P.O. Box 990, Minneapolis, MN 55440.

Additional description of the company’s business is found in Part II, Item 7 of this report.

Financial Information About Reportable Segments

The company’s business is classified by management into two reportable segments: Retail food and food

distribution. Retail food operations include three retail formats: extreme value stores, regional price superstores

and regional supermarkets. The retail formats include results of food stores owned and results of sales to extreme

value stores licensed by the company. Food distribution operations include results of sales to affiliated food

stores, mass merchants and other customers, and other logistics arrangements. Management utilizes more than

one measurement and multiple views of data to assess segment performance and to allocate resources to the

segments. However, the dominant measurements are consistent with the consolidated financial statements. The

financial information concerning the company’s operations by reportable segment for the years ended

February 22, 2003, February 23, 2002 and February 24, 2001 is contained on page F-5.

2