eBay 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our computation of expected volatility for 2011 , 2010 and 2009 was based on a combination of historical and market-based implied

volatility from traded options on our stock. Our computation of expected life was determined based on historical experience of similar awards,

giving consideration to the contractual terms of the stock-based awards, vesting schedules and expectations of future employee behavior. The

interest rate for periods within the contractual life of the award was based on the U.S. Treasury yield curve in effect at the time of grant. The

estimation of awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from our current

estimates, such amounts will be recorded as a cumulative adjustment in the period estimates are revised. We consider many factors when

estimating forfeitures, including employee class and historical experience.

Recent Accounting Pronouncements

See “Note 1 - The Company and Summary of Significant Accounting Policies” to the consolidated financial statements included in this

report, regarding the impact of certain recent accounting pronouncements on our consolidated financial statements.

Item 7A: Quantitative and Qualitative Disclosures About Market Risk

Foreign Currency Exposure

We have significant operations internationally that are denominated in foreign currencies, primarily the Euro, British pound, Korean won,

Australian dollar and Canadian dollar, subjecting us to foreign currency risk which may adversely impact our financial results. We transact

business in various foreign currencies and have significant international revenues as well as costs. In addition, we charge our international

subsidiaries for their use of intellectual property and technology and for certain corporate services provided by eBay and by PayPal. Our cash

flow, results of operations and certain of our intercompany balances that are exposed to foreign exchange rate fluctuations may differ materially

from expectations and we may record significant gains or losses due to foreign currency fluctuations and related hedging activities.

We have a foreign exchange exposure management program that aims to identify material foreign currency exposures, to manage these

exposures, and to minimize the potential effects of currency fluctuations on our reported consolidated cash flows and results of operations through

the purchase of foreign currency exchange contracts. These foreign currency exchange contracts are accounted for as derivative instruments. For

additional details related to our derivative instruments, please see “Note 9 - Derivative Instruments” to the consolidated financial statements

included in this report.

Interest Rate Risk

The primary objective of our investment activities is to preserve principal while at the same time maximizing yields without significantly

increasing risk. To achieve this objective, we maintain our portfolio of cash equivalents and short-term and long-term investments in a variety of

available for sale securities, including money market funds and government and corporate securities. As of December 31, 2011 , approximately

56% of our total cash and investment portfolio was held in bank deposits and money market funds. As such, changes in interest rates will impact

our interest income. In addition, we regularly issue new commercial paper notes to repay outstanding commercial paper notes as they mature, and

those new commercial paper notes bear interest at rates prevailing at the time of issuance. Accordingly, changes in interest rates will impact

interest expense or cost of net revenues. As of December 31, 2011 , we held no direct investments in auction rate securities, collateralized debt

obligations, structured investment vehicles or mortgage-backed securities. For additional details related to our investment activities, please see

"Note 7 - Investments" to the consolidated financial statements included in this report.

Investments in both fixed-rate and floating-rate interest-

earning instruments carry varying degrees of interest rate risk. The fair market value

of our fixed-rate securities may be adversely impacted due to a rise in interest rates. In general, securities with longer maturities are subject to

greater interest-rate risk than those with shorter maturities. While floating rate securities generally are subject to less interest-rate risk than fixed-

rate securities, floating-rate securities may produce less income than expected if interest rates decrease. Due in part to these factors, our

investment income may fall short of expectations or we may suffer losses in principal if securities are sold that have declined in market value due

to changes in interest rates. As of

70

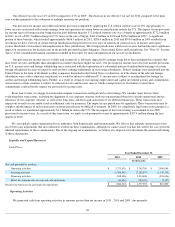

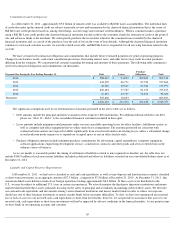

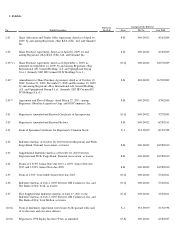

Year Ended December 31,

2011

2010

2009

Risk-free interest rate

1.2

%

1.4

%

1.7

%

Expected life (in years)

3.8

3.4

3.8

Dividend yield —

%

—

%

—

%

Expected volatility

38

%

37

%

47

%