eBay 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

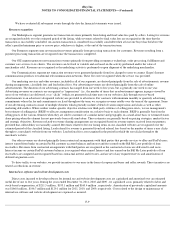

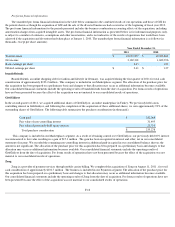

Concentration of credit risk

Our cash, cash equivalents, accounts receivable, loans and interest receivable, funds receivable and customer accounts are potentially subject

to concentration of credit risk. Cash, cash equivalents and customer accounts are placed with financial institutions that management believes are of

high credit quality. In addition, funds receivable are generated with financial institutions or credit card companies that management believes are of

high credit quality. Our accounts receivable are derived from revenue earned from customers located in the U.S. and internationally. Our loans and

interest receivable are derived from consumer financing activities for customers located in the U.S. As of December 31, 2011 and 2010 , no

customer accounted for more than 10% of net accounts receivable or net loans receivable. During the years ended December 31, 2011, 2010 and

2009 , no customer accounted for more than 10% of net revenues.

Recent Accounting Pronouncements

In 2011, the Financial Accounting Standards Board ("FASB") issued new accounting guidance that amends some fair value measurement

principles and disclosure requirements. The new guidance states that the concepts of highest and best use and valuation premise are only relevant

when measuring the fair value of nonfinancial assets and prohibits the grouping of financial instruments for purposes of determining their fair

values when the unit of account is specified in other guidance. We will adopt this accounting standard upon its effective date for periods beginning

on or after December 15, 2011, and do not anticipate that this adoption will have a significant impact on our financial position or results of

operations.

In 2011, the FASB issued new disclosure guidance related to the presentation of the Statement of Comprehensive Income. This guidance

eliminates the current option to report other comprehensive income and its components in the consolidated statement of stockholders' equity. The

requirement to present reclassification adjustments out of accumulated other comprehensive income on the face of the consolidated statement of

income has been deferred. We will adopt this accounting standard upon its effective date for periods beginning on or after December 15, 2011,

and this adoption will not have any impact on our financial position or results of operations but will impact our financial statement presentation.

In 2011, the FASB issued new accounting guidance that simplifies goodwill impairment tests. The new guidance states that a "qualitative"

assessment may be performed to determine whether further impairment testing is necessary. We will adopt this accounting standard upon its

effective date for periods beginning on or after December 15, 2011, and do not anticipate that this adoption will have a significant impact on our

financial position or results of operations.

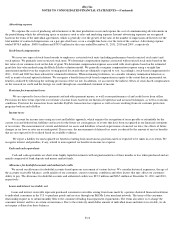

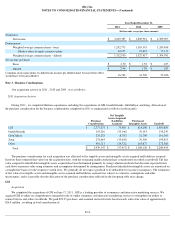

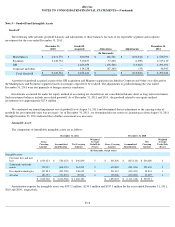

Note 2 – Net Income Per Share

Basic net income per share is computed by dividing net income for the period by the weighted average number of common shares

outstanding during the period. Diluted net income per share is computed by dividing net income for the period by the weighted average number of

shares of common stock and potentially dilutive common stock outstanding during the period. The dilutive effect of outstanding options and

restricted stock is reflected in diluted net income per share by application of the treasury stock method. The calculation of diluted net income per

share excludes all anti-dilutive shares. The following table sets forth the computation of basic and diluted net income per share for the periods

indicated:

F-13