eBay 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

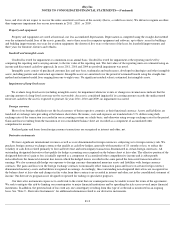

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 3 - Business Combinations

Our acquisition activity in 2011 , 2010 and 2009 , was as follows:

2011 Acquisition Activity

During 2011 , we completed thirteen acquisitions, including the acquisitions of GSI, brands4friends, GittiGidiyor and Zong. Allocation of

the purchase consideration for the business combinations completed in 2011 is summarized as follows (in thousands):

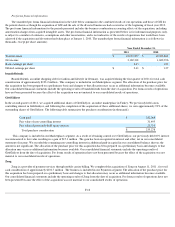

The purchase consideration for each acquisition was allocated to the tangible assets and intangible assets acquired and liabilities assumed

based on their estimated fair values on the acquisition date, with the remaining unallocated purchase consideration recorded as goodwill. The fair

value assigned to identifiable intangible assets acquired has been determined primarily by using valuation methods that discount expected future

cash flows to present value using estimates and assumptions determined by management. Purchased identifiable intangible assets are amortized on

a straight-

line basis over the respective useful lives. We generally do not expect goodwill to be deductible for income tax purposes. The estimation

of fair values for tangible assets and intangible assets acquired and liabilities assumed was subject to estimates, assumptions and other

uncertainties, and it is possible that the allocation of the purchase consideration reflected in the foregoing table may change.

GSI

Acquisition

We completed the acquisition of GSI on June 17, 2011 . GSI is a leading provider of ecommerce and interactive marketing services. We

acquired GSI to utilize its comprehensive integrated suite of online commerce and interactive marketing services to strengthen our ability to

connect buyers and sellers worldwide. We paid $29.25 per share, and assumed restricted stock-based awards with a fair value of approximately

$24.8 million , resulting in total consideration of

F-14

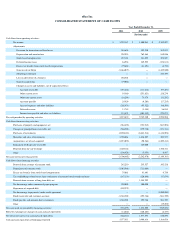

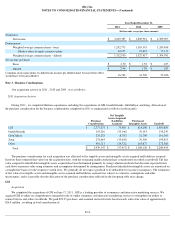

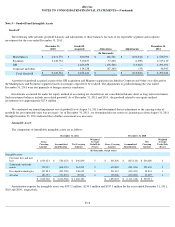

Year Ended December 31,

2011

2010

2009

(In thousands, except per share amounts)

Numerator:

Net income

$

3,229,387

$

1,800,961

$

2,389,097

Denominator:

Weighted average common shares - basic

1,292,775

1,305,593

1,289,848

Dilutive effect of equity incentive plans

20,175

21,824

15,133

Weighted average common shares - diluted

1,312,950

1,327,417

1,304,981

Net income per share:

Basic

$

2.50

$

1.38

$

1.85

Diluted

$

2.46

$

1.36

$

1.83

Common stock equivalents excluded from income per diluted share because their effect

would have been anti-dilutive

16,762

31,509

53,026

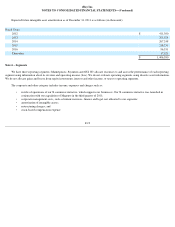

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed) Purchased

Intangible Assets Goodwill

GSI

$

2,377,257

$

74,498

$

819,100

$

1,483,659

brands4friends

193,236

(33,146

)

76,143

150,239

GittiGidiyor

235,278

(8,787

)

52,700

191,365

Zong

231,663

(35,650

)

76,500

190,813

Other

401,713

(34,332

)

163,677

272,368

Total

$

3,439,147

$

(37,417

)

$

1,188,120

$

2,288,444