eBay 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

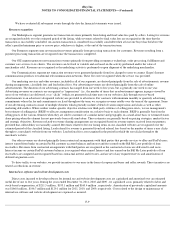

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

basis, and if we do not expect to recover the entire amortized cost basis of the security (that is, a credit loss exists). We did not recognize an other-

than-temporary impairment loss on our investments in 2011 , 2010 , or 2009.

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the straight-line method

over the estimated useful lives of the assets, generally, one to three years for computer equipment and software, up to thirty years for buildings

and building improvements, ten years for aviation equipment, the shorter of five years or the term of the lease for leasehold improvements and

three years for furniture, fixtures and vehicles.

Goodwill and intangible assets

Goodwill is tested for impairment at a minimum on an annual basis. Goodwill is tested for impairment at the reporting unit level by

comparing the reporting unit's carrying amount, to the fair value of the reporting unit. The fair values of the reporting units are estimated using an

income and discounted cash flow approach. In years 2011, 2010 and 2009 no goodwill impairment was noted.

Intangible assets consist of

purchased customer lists and user base, trademarks and trade names, developed technologies and other intangible

assets, including patents and contractual agreements. Intangible assets are amortized over the period of estimated benefit using the straight-line

method and estimated useful lives ranging from one to eight years. No significant residual value is estimated for intangible assets.

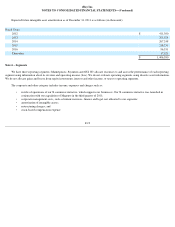

Impairment of long-lived assets

We evaluate long-lived assets (including intangible assets) for impairment whenever events or changes in circumstances indicate that the

carrying amount of a long-lived asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the undiscounted

future net cash flow the asset is expected to generate. In years 2011, 2010 and 2009, no impairment was noted.

Foreign currency

Most of our foreign subsidiaries use the local currency of their respective countries as their functional currency. Assets and liabilities are

translated at exchange rates prevailing at the balance sheet dates. Revenues, costs and expenses are translated into U.S. dollars using daily

exchange rates if the transaction is recorded in our accounting systems on a daily basis, and otherwise using average exchange rates for the period.

Gains and losses resulting from the translation of our consolidated balance sheet are recorded as a component of accumulated other

comprehensive income.

Realized gains and losses from foreign currency transactions are recognized as interest and other, net.

Derivative instruments

We have significant international revenues as well as costs denominated in foreign currencies, subjecting us to foreign currency risk. We

purchase foreign currency exchange contracts that qualify as cash flow hedges, generally with maturities of 18 months or less, to reduce the

volatility of cash flows related primarily to forecasted revenue and intercompany transactions denominated in certain foreign currencies. All

outstanding designated derivatives that qualify for hedge accounting are recognized on the balance sheet at fair value. The effective portion of the

designated derivative's gain or loss is initially reported as a component of accumulated other comprehensive income and is subsequently

reclassified into the financial statement line item in which the hedged item is recorded in the same period the forecasted transaction affects

earnings. We also economically hedge our exposure to foreign currency denominated monetary assets and liabilities with foreign currency

contracts. The gains and losses on the foreign exchange contracts economically offset transaction gains and losses on certain foreign currency

denominated monetary assets and liabilities recognized in earnings. Accordingly, these outstanding non-designated derivatives are recognized on

the balance sheet at fair value and changes in fair value from these contracts are recorded in interest and other, net in the consolidated statement of

income. Our derivatives program is not designed or operated for trading or speculative purposes.

Our derivative instruments expose us to credit risk to the extent that our counterparties may be unable to meet the terms of the agreements.

We seek to mitigate this risk by limiting our counterparties to major financial institutions and by spreading the risk across several major financial

institutions. In addition, the potential risk of loss with any one counterparty resulting from this type of credit risk is monitored on an ongoing

basis. See “Note 9 - Derivative Instruments” for additional information related to our derivative instruments.

F-12