eBay 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

performance under the subject agreement. GSI in many of its major online commerce agreements has provided an indemnity for other types of

third-party claims, which are indemnities mainly related to various intellectual property rights, and we have provided similar indemnities in a

limited number of agreements for our other businesses. In our PayPal business, we have provided an indemnity to our payment processors in the

event of certain third-party claims or card association fines against the processor arising out of conduct by PayPal or PayPal customers. In

connection with the sale of Skype, we made certain customary warranties to the buyer in the purchase agreement. Our liability to the buyer for

inaccuracies in these warranties is generally subject to certain limitations. With respect to certain specified litigation matters involving Skype that

were pending as of the closing of the transaction, we also agreed, among other things, to bear 50% of the cost of any monetary judgment that is

rendered in respect of those matters. It is not possible to determine the maximum potential loss under these indemnification provisions due to our

limited history of prior indemnification claims and the unique facts and circumstances involved in each particular provision. To date, losses

recorded in our statement of income in connection with our indemnification provisions have not been significant, either individually or

collectively.

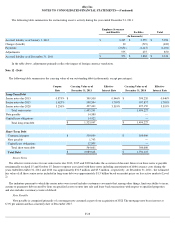

Off-Balance Sheet Arrangements

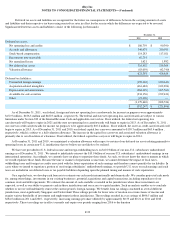

Based on differences in regulatory requirements and commercial law in the jurisdictions where PayPal operates, PayPal holds customer

balances either as direct claims against PayPal or as an agent or custodian on behalf of PayPal's customers. Customer funds held by PayPal as an

agent or custodian on behalf of our customers are not reflected in our consolidated balance sheet. These off-balance sheet funds totaled

approximately $2.7 billion as of December 31, 2011 and 2010 . These funds include funds held on behalf of U.S. customers that are deposited in

bank accounts insured by the Federal Deposit Insurance Corporation (subject to applicable limits).

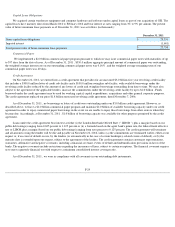

Note 14 - Related Party Transactions

We have entered into indemnification agreements with each of our directors, executive officers and certain other officers. These agreements

require us to indemnify such individuals, to the fullest extent permitted by Delaware law, for certain liabilities to which they may become subject

as a result of their affiliation with us.

All contracts with related parties are at rates and terms that we believe are comparable with those that could be entered into with

independent third parties. There were no material related party transactions in 2011 . As of December 31, 2011

, there were no significant amounts

payable to or amounts receivable from related parties.

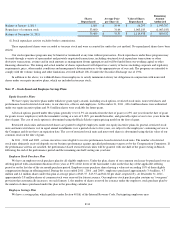

Note 15 - Stockholders' Equity

Preferred Stock

We are authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series; to establish the number

of shares included within each series; to fix the rights, preferences and privileges of the shares of each wholly unissued series and any related

qualifications, limitations or restrictions; and to increase or decrease the number of shares of any series (but not below the number of shares of a

series then outstanding) without any further vote or action by our stockholders. At December 31, 2011 and 2010 , there were 10.0 million shares

of $0.001 par value preferred stock authorized for issuance, and no shares issued or outstanding.

Common Stock

Our Certificate of Incorporation, as amended, authorizes us to issue 3.6 billion shares of common stock.

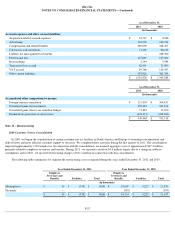

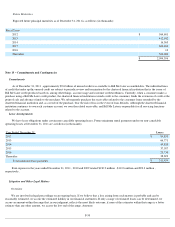

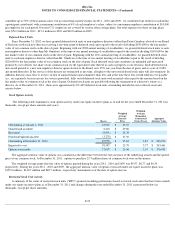

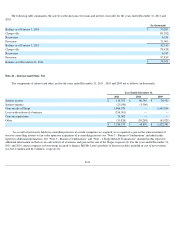

Note 16 – Stock Repurchase Program

In September 2010, our Board authorized a stock repurchase program that provides for the repurchase of up to $2.0 billion of our common

stock, with no expiration from the date of authorization, for the purpose of offsetting the impact of dilution from our equity compensation

programs. The stock repurchase activity under this stock repurchase program during 2011 is summarized as follows (in thousands, except per

share amounts):

F-33