eBay 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

of business operations in the respective jurisdictions.

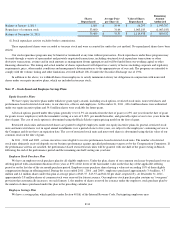

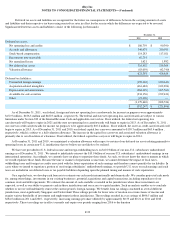

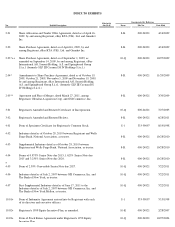

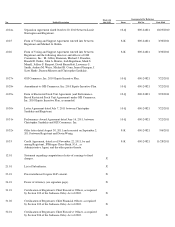

The following table reflects changes in unrecognized tax benefits since January 1, 2010:

In the second quarter of 2011, we settled multiple uncertain tax positions resulting in an overall decrease in our unrecognized tax benefits.

As of December 31, 2011, our liabilities for unrecognized tax benefits were included in deferred and other tax liabilities, net. As of December 31,

2010, $208.5 million of our liabilities for unrecognized tax benefits were included in accrued expenses and other current liabilities and the

remaining amount is recorded as deferred and other tax liabilities.

We recognize interest and/or penalties related to uncertain tax positions in income tax expense. In 2011, we recognized interest and penalties

of $18.4 million . The amount of interest and penalties accrued as of December 31, 2011 and 2010 was approximately $83.2 million and $92.3

million , respectively.

We are subject to both direct and indirect taxation in the U.S. and various states and foreign jurisdictions. We are under examination by

certain tax authorities for the 2003 to 2009 tax years. We believe that adequate amounts have been reserved for any adjustments that may

ultimately result from these examinations. The material jurisdictions where we are subject to potential examination by tax authorities for tax years

after 2002 include, among others, the U.S. (Federal and California), France, Germany, Italy, Korea, Israel, Switzerland, Singapore and Canada.

Although the timing of the resolution and/or closure of audits is highly uncertain, it is reasonably possible that the balance of gross

unrecognized tax benefits could significantly change in the next 12 months. However, given the number of years remaining subject to examination

and the number of matters being examined, we are unable to estimate the full range of possible adjustments to the balance of gross unrecognized

tax benefits.

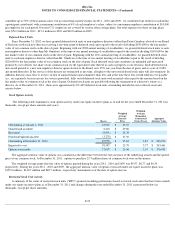

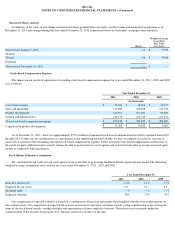

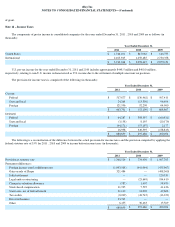

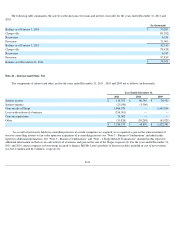

Note 19 - Loans and Interest Receivable, Net

Loans and interest receivable represent purchased consumer receivables arising from loans made by a partner chartered financial

institution to individual consumers in the U.S. to purchase goods and services through our Bill Me Later merchant network. During the years

ended December 31, 2011 and 2010, we purchased approximately $2.3 billion and $1.4 billion , respectively, in consumer receivables. Loans and

interest receivable are reported at their outstanding principal balances, including unamortized deferred origination costs and net of allowance, and

include the estimated collectible interest and fees. We use a consumer's FICO score, among other measures, in evaluating the credit quality of our

consumer receivables. A FICO score is a type of credit score that lenders use to assess an applicant's credit risk and whether to extend credit.

Individual FICO scores generally are obtained each quarter the consumer has an outstanding loan receivable owned by Bill Me Later. The

weighted average consumer FICO score related to our loans and interest receivable balance outstanding at December 31, 2011 was 692 . As of

December 31, 2011 and 2010 , approximately 59.3% and 63.6% , respectively, of our loans and interest receivable balance was due from

consumers with FICO scores greater than 680 , which is generally considered "prime" by the consumer credit industry. As of December 31, 2011

,

approximately 91% of our loans and interest receivable portfolio were current.

F-40

2011

2010

(In thousands)

Gross amounts of unrecognized tax benefits as of the beginning of the period

$

428,344

$

838,616

Increases related to prior period tax positions

32,582

33,904

Decreases related to prior period tax positions

(138,746

)

(305,874

)

Increases related to current period tax positions

40,926

22,229

Settlements

(77,386

)

(160,531

)

Gross amounts of unrecognized tax benefits as of the end of the period

$

285,720

$

428,344