eBay 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

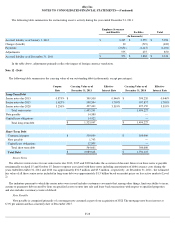

Note 11 – Restructuring

2009 Customer Service Consolidation

In 2009, we began the consolidation of certain customer service facilities in North America and Europe to streamline our operations and

deliver better and more efficient customer support to our users. We completed these activities during the first quarter of 2011. The consolidation

impacted approximately 1,000 employees. In connection with the consolidation, we incurred aggregate costs of approximately $47.2 million ,

primarily related to employee severance and benefits. During 2011 , we incurred a credit of $0.5 million largely due to a change in sublease

assumptions and in 2010 , we incurred restructuring charges of $21.4 million in connection with this consolidation.

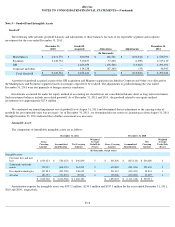

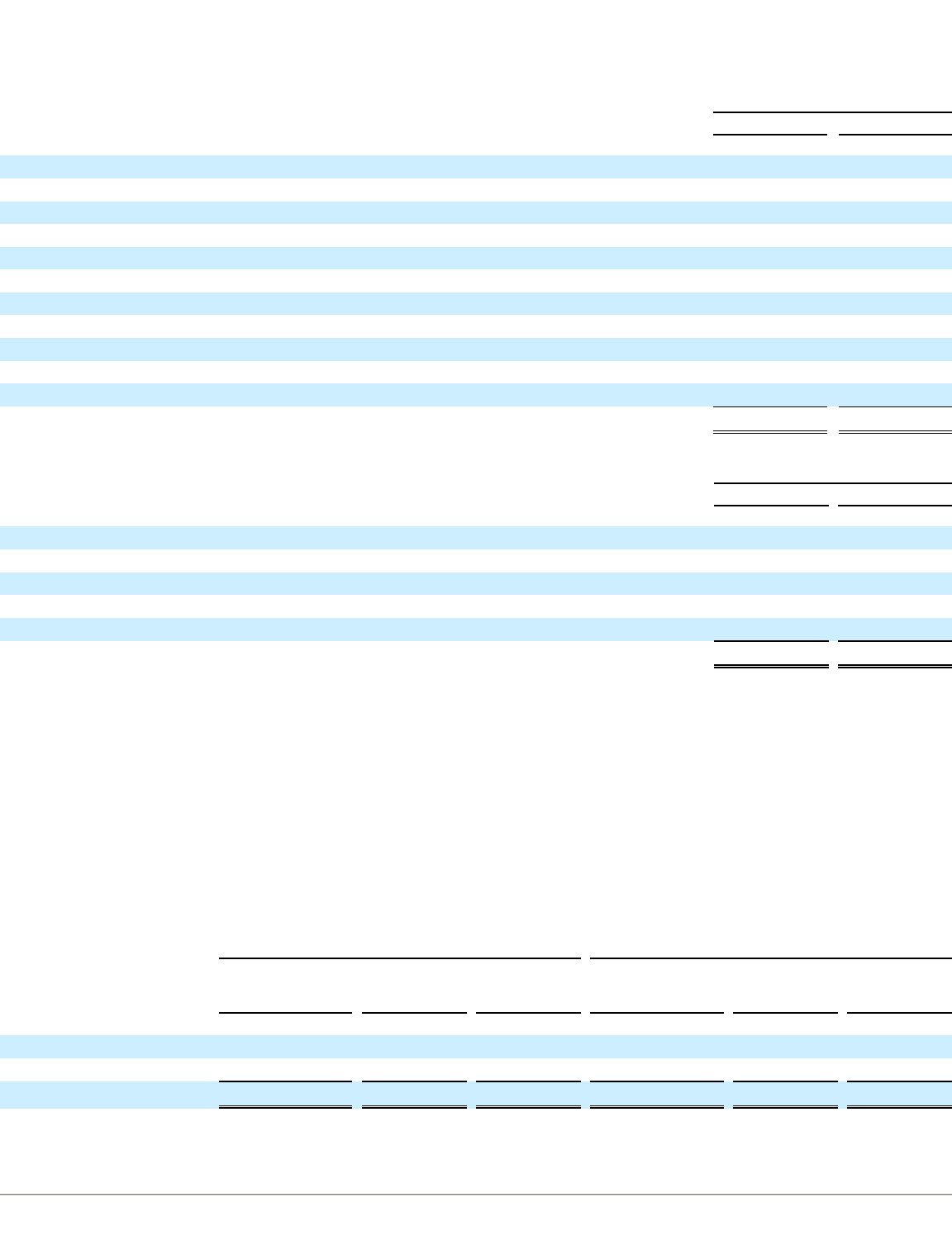

The following table summarizes by segment the restructuring costs recognized during the years ended December 31, 2011 and 2010 :

F-27

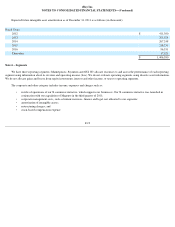

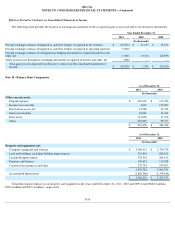

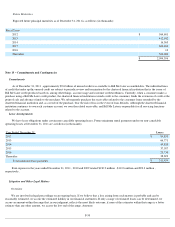

As of December 31,

2011

2010

(In thousands)

Accrued expenses and other current liabilities:

Acquisition related accrued expenses

$

23,747

$

8,266

Advertising

101,296

100,314

Compensation and related benefits

489,090

348,497

Contractors and consultants

71,209

66,216

Liability for unrecognized tax benefits

—

208,500

Professional fees

127,665

147,880

Restructuring

2,244

5,984

Transaction loss accrual

62,401

31,900

VAT accrual

99,366

124,943

Other current liabilities

533,818

301,388

$

1,510,836

$

1,343,888

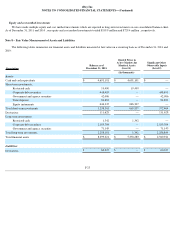

As of December 31,

2011

2010

(In thousands)

Accumulated other comprehensive income:

Foreign currency translation

$

113,905

$

394,835

Unrealized gains on investments

587,985

531,181

Unrealized gains (losses) on cash flow hedges

71,849

13,560

Estimated tax provision on above items

(224,271

)

(188,262

)

$

549,468

$

751,314

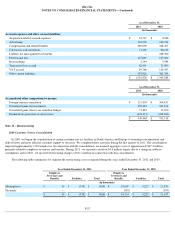

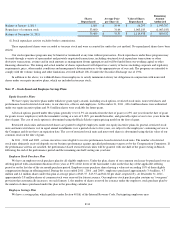

Year Ended December 31, 2011

Year Ended December 31, 2010

Employee

Severance and

Benefits

Facilities

Total

Employee

Severance and

Benefits

Facilities

Total

(In thousands)

Marketplaces

$

30

$

(519

)

$

(489

)

$

18,607

$

3,223

$

21,830

Payments

—

—

—

(

393

)

—

(

393

)

$

30

$

(519

)

$

(489

)

$

18,214

$

3,223

$

21,437