eBay 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

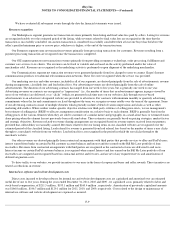

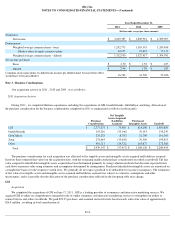

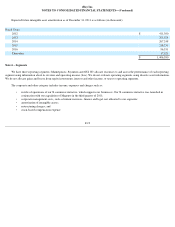

Note 5 – Goodwill and Intangible Assets

Goodwill

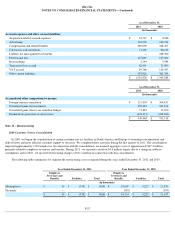

The following table presents goodwill balances and adjustments to those balances for each of our reportable segments and corporate

investments for the year ended December 31, 2011 :

A portion of goodwill acquired as part of the GSI acquisition and Magento acquisition (included in Corporate and Other) was allocated to

the Marketplaces and Payments segments based on synergies expected to be realized. The adjustments to goodwill during the year ended

December 31, 2011 were due primarily to foreign currency translation.

Investments accounted for under the equity method of accounting are classified on our consolidated balance sheet as long-term investments.

Such investment balances include any related goodwill. As of December 31, 2011 and 2010 , the goodwill related to our equity method

investments was approximately $27.4 million .

We conducted our annual impairment test of goodwill as of August 31, 2011 and determined that no adjustment to the carrying value of

goodwill for any reportable units was necessary. As of December 31, 2011 , we determined that no events or circumstances from August 31, 2011

through December 31, 2011 indicated that a further assessment was necessary.

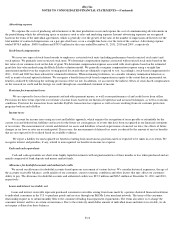

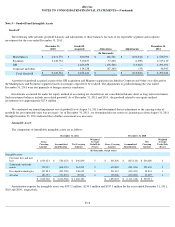

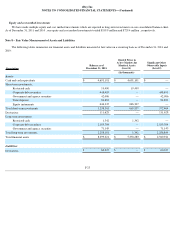

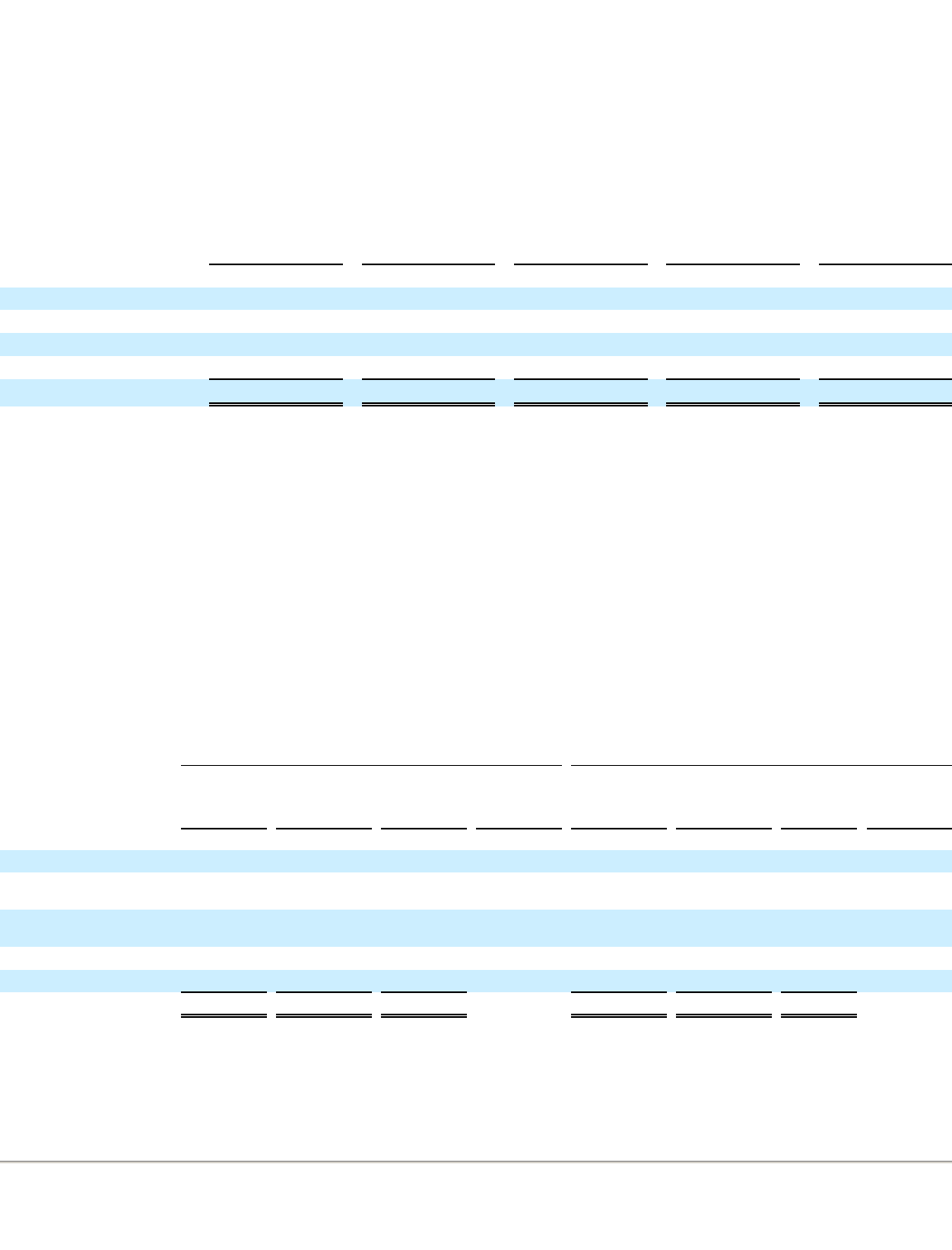

Intangible Assets

The components of identifiable intangible assets are as follows:

Amortization expense for intangible assets was $337.2 million , $254.1 million and $337.5 million for the years ended December 31, 2011 ,

2010 and 2009 , respectively.

F-18

December 31,

2010

Goodwill

Acquired Allocations

Adjustments December 31,

2011

(In thousands)

Marketplaces

$

4,071,772

$

380,090

$

186,560

$

(101,632

)

$

4,536,790

Payments

2,148,752

310,457

57,200

(1,290

)

2,515,119

GSI

—

1,483,659

(176,500

)

(13,665

)

1,293,494

Corporate and other

—

114,238

(67,260

)

(33

)

46,945

Total Goodwill

$

6,220,524

$

2,288,444

$

—

$

(

116,620

)

$

8,392,348

December 31, 2011

December 31, 2010

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Weighted

Average

Useful Life

(Years)

Gross Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted

Average

Useful Life

(Years)

(In thousands, except years)

Intangible assets:

Customer lists and user

base

$

1,633,423

$

(786,623

)

$

846,800

5

$

831,806

$

(625,126

)

$

206,680

6

Trademarks and trade

names

729,907

(468,905

)

261,002

5

632,899

(381,456

)

251,443

5

Developed technologies

497,883

(249,228

)

248,655

3

231,312

(192,421

)

38,891

3

All other

181,755

(131,832

)

49,923

4

156,306

(112,609

)

43,697

4

$

3,042,968

$

(1,636,588

)

$

1,406,380

$

1,852,323

$

(1,311,612

)

$

540,711