WeightWatchers 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

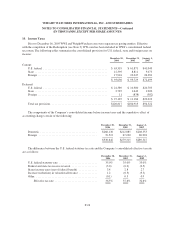

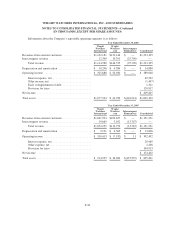

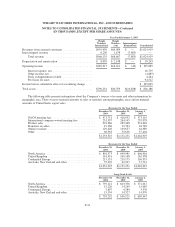

17. Quarterly Financial Information (Unaudited)

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended December 30, 2006 and December 31, 2005.

For the Fiscal Quarters Ended

April 1,

2006

July 1,

2006

September 30,

2006

December 30,

2006

Fiscal year ended December 30, 2006

Revenues, net ..................................... $342,048 $321,059 $284,753 $285,465

Gross profit ....................................... 192,493 180,491 155,723 147,453

Operating income .................................. 104,075 105,423 92,289 78,261

Net income ....................................... 56,997 57,917 50,615 44,296

Basic EPS ........................................ 0.57 0.58 0.52 0.45

Diluted EPS ....................................... 0.56 0.58 0.52 0.45

For the Fiscal Quarters Ended

April 2,

2005

July 2,

2005

October 1,

2005

December 31,

2005

Fiscal year ended December 31, 2005

Revenues, net ..................................... $329,998 $312,600 $257,483 $251,170

Gross profit ....................................... 181,920 176,221 142,172 130,256

Operating income .................................. 90,027 160,488 84,663 67,314

Net income ....................................... 51,628 34,472 49,452 38,850

Basic EPS ........................................ 0.50 0.33 0.48 0.38

Diluted EPS ....................................... 0.49 0.33 0.47 0.38

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum

of the quarterly EPS amounts may not agree to the total for the year. During the fourth quarter of fiscal 2006, the

Company recorded a net tax benefit of approximately $6,300 by reversing tax reserves which due to the

resolution of certain tax matters were no longer necessary, partially offset by adjustments to its tax valuation

allowance for foreign tax net operating loss carryforwards. During the fiscal quarters ended July 2, 2005 and

October 1, 2005, the Company incurred expenses associated with the WW.com acquisition (See Note 3) of

$46,082 and $309, respectively.

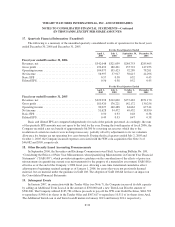

18. Other Recently Issued Accounting Pronouncements

In September 2006, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 108,

“Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial

Statements” (“SAB 108”), which provides interpretive guidance on the consideration of the effects of prior year

misstatements in quantifying current year misstatements for the purpose of a materiality assessment. SAB 108 is

effective as of the end of the Company’s 2006 fiscal year, allowing a one-time transitional cumulative effect

adjustment to beginning retained earnings as of January 1, 2006, for errors that were not previously deemed

material, but are material under the guidance in SAB 108. The adoption of SAB 108 did not have an impact on

the Consolidated Financial Statements.

19. Subsequent Events

In January 2007, in connection with the Tender Offer (see Note 7), the Company increased its debt capacity

by adding an Additional Term Loan A in the amount of $700,000 and a new Term Loan B in the amount of

$500,000. The Company utilized $185,784 of these proceeds to pay off the WW.com Credit Facilities, $461,593

to repurchase 8,548 of its shares in the Tender Offer and $567,617 to repurchase 10,511 of its shares from Artal.

The Additional Term Loan A and Term Loan B mature in January 2013 and January 2014, respectively.

F-33