WeightWatchers 2006 Annual Report Download - page 90

Download and view the complete annual report

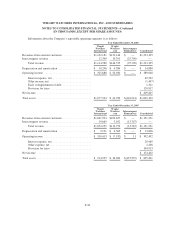

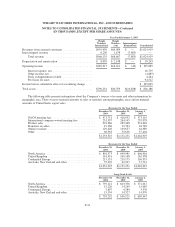

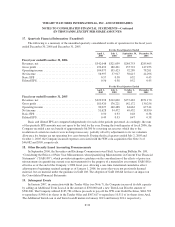

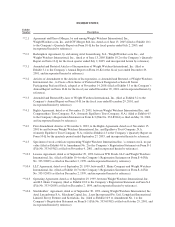

Please find page 90 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Service Agreement:

Simultaneous with the signing of the amended and restated intellectual property license agreement, WWI

entered into a service agreement with WeightWatchers.com, under which WeightWatchers.com provides certain

types of services. WWI is required to pay for all expenses incurred by WeightWatchers.com directly attributable

to the services it performs under this agreement, plus a fee of 10% of those expenses. The Company recorded

service expense of $558 for the year ended January 1, 2005 that was included in marketing expenses.

Ancillary Agreements:

In addition to the license agreement and service agreement, WWI and WW.com entered into various

ancillary agreements in the normal course of business related to the sharing of space, financial, legal and

administrative services, and other resources.

WeightWatchers.com Acquisition:

See Note 3 for a description of our acquisition of WW.com and the related transactions with Artal.

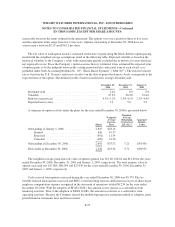

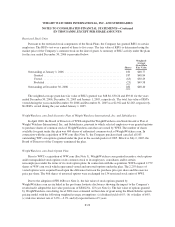

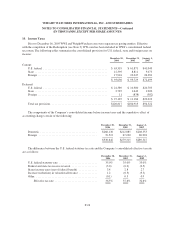

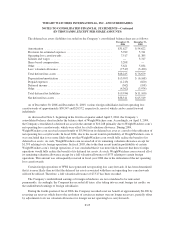

12. Employee Benefit Plans

The Company sponsors the Weight Watchers Savings Plan (the “Savings Plan”) for salaried and hourly

employees of WWI. In January 2001, the Company permitted the employees of WW.com to participate in the

Savings Plan. Beginning in January 2006, WW.com employees were eligible for employer matching

contributions. The Savings Plan is a defined contribution plan that provides for employer matching contributions

up to 100% of the first 3% of an employee’s eligible compensation. The Savings Plan also permits employees to

contribute between 1% and 13% of eligible compensation on a pre-tax basis. Expense related to these

contributions for the fiscal years ended December 30, 2006, December 31, 2005 and January 1, 2005 was $2,239,

$1,529 and $1,361, respectively.

During fiscal 2002, the Company received a favorable determination letter from the IRS that qualifies

WWI’s Savings Plan under Section 401(a) of the Internal Revenue Code.

The Company sponsors the Weight Watchers Profit Sharing Plan (the “Profit Sharing Plan”) for all full-time

salaried employees who are eligible to participate in the Savings Plan (except for certain senior management

personnel). The Profit Sharing Plan provides for a guaranteed monthly employer contribution on behalf of each

participant based on the participant’s age and a percentage of the participant’s eligible compensation. The Profit

Sharing Plan has a supplemental employer contribution component, based on WWI’s achievement of certain

annual performance targets, which are determined annually by the Board of Directors. The Company also

reserves the right to make additional discretionary contributions to the Profit Sharing Plan. Expense related to

these contributions for the fiscal years ended December 30, 2006, December 31, 2005 and January 1, 2005 was

$2,393, $1,975 and $1,808, respectively.

For certain senior management personnel of WWI, the Company sponsors the Weight Watchers Executive

Profit Sharing Plan. Under the Internal Revenue Service (“IRS”) definition, this plan is considered a

Nonqualified Deferred Compensation Plan. There is a promise of payment by the Company made on the

employees’ behalf instead of an individual account with a cash balance. The account is valued at the end of each

fiscal month, based on an annualized interest rate of prime plus 2%, with an annualized cap of 15%. Expense

F-27