WeightWatchers 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

WW.com and issuances of equity securities of WW.com; and (ii) may be voluntarily prepaid at any time in

whole or in part without premium or penalty, with certain exceptions depending upon the date of payment. The

rights and priorities of the lenders under the WW.com Credit Facilities are governed by an intercreditor

agreement.

The WW.com Credit Facilities contain customary covenants, including affirmative and negative covenants

that, in certain circumstances, restrict WW.com’s ability to incur additional indebtedness, pay dividends on and

redeem capital stock, make other restricted payments, including investments, sell WW.com assets and enter into

consolidations, mergers and transfer of all or substantially all of WW.com’s assets. The WW.com Credit

Facilities also require WW.com to maintain specified financial ratios and satisfy financial condition tests, which

become more restrictive over time. At December 30, 2006 WW.com complied with all of the required financial

ratios and also met all of the financial condition tests and is expected to continue to do so. The WW.com Credit

Facilities contain customary events of default. Upon the occurrence of an event of default under the WW.com

Credit Facilities, the lenders thereunder may cease making loans and declare amounts outstanding to be

immediately due and payable. Each of WW.com’s existing and future domestic subsidiaries have guaranteed the

WW.com Credit Facilities, which facilities are secured by substantially all the assets of WW.com and these

subsidiaries. WWI has not guaranteed the WW.com Credit Facilities.

On November 4, 2005, Standard & Poor’s assigned its “B+” corporate credit rating to WW.com. In addition,

Standard & Poor’s assigned ratings of “B+” to the First Lien Term Credit Facility and “B-” to the Second Lien

Term Credit Facility. On September 22, 2006, Moody’s assigned ratings of “Ba2” to the First Lien Term Credit

Facility and “B2” to the Second Lien Term Credit Facility.

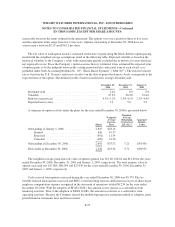

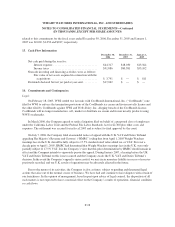

Maturities

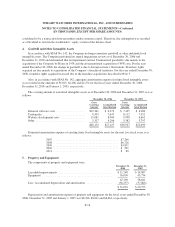

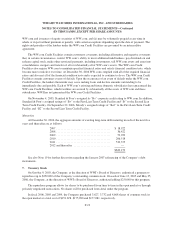

At December 30, 2006, the aggregate amounts of existing long-term debt maturing in each of the next five

years and thereafter are as follows:

2007 ...................................... $ 18,922

2008 ...................................... 36,422

2009 ...................................... 53,922

2010 ...................................... 206,518

2011 ...................................... 533,375

2012 and thereafter .......................... —

$849,159

See also Note 19 for further discussion regarding the January 2007 refinancing of the Company’s debt

instruments.

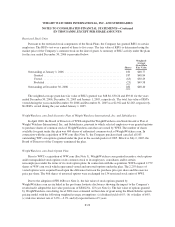

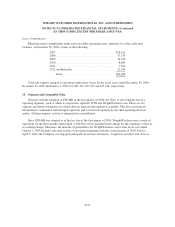

7. Treasury Stock

On October 9, 2003, the Company, at the direction of WWI’s Board of Directors, authorized a program to

repurchase up to $250,000 of the Company’s outstanding common stock. On each of June 13, 2005 and May 25,

2006, the Company, at the direction of WWI’s Board of Directors, authorized adding $250,000 to this program.

The repurchase program allows for shares to be purchased from time to time in the open market or through

privately negotiated transactions. No shares will be purchased from Artal under the program.

In fiscal 2006, 2005 and 2004, the Company purchased 3,627, 3,732 and 4,668 shares of common stock in

the open market at a total cost of $151,678, $175,980 and $177,081, respectively.

F-19