WeightWatchers 2006 Annual Report Download - page 48

Download and view the complete annual report

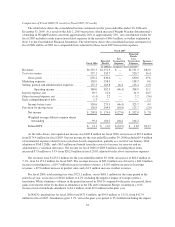

Please find page 48 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of acquisitions, 2.9% without the benefit of acquisitions. Meeting fee growth outpaced attendance growth in the

period, with the average meeting fee per attendee up 7.1% over the prior year. The increase in meeting fee per

attendee resulted from the positive impact of our two new commitment plans, Season Pass and Monthly Pass, and

from a one dollar price rise in approximately 40% of our markets. With Season Pass, a pricing plan which was

first launched throughout NACO for our 2006 winter diet season and offered again in the spring, members pay in

advance, in full, for 17 consecutive weeks of meetings at a discounted price. Monthly Pass, first introduced in our

2006 fall diet season, is a recurring billing model whereby the member authorizes us to charge her credit card on

a monthly basis, at a discounted rate, until the member elects to cancel. The increase in the average meeting fee

arises because not all members who purchase Season Pass and Monthly Pass will attend all the meetings for

which they have paid.

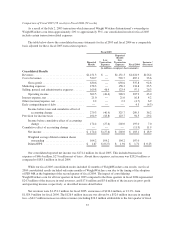

International company-owned meeting fees were $251.3 million for fiscal 2006, a decrease of $12.8 million

or 4.8%, from $264.1 million for fiscal 2005. On a local currency basis, meeting fee revenues declined 4.7%

from the comparable prior year period. International meeting fees were negatively impacted by a 7.4% decline in

UK attendance, from 12.6 million in fiscal 2005 to 11.6 million in fiscal 2006, and a 4.4% decline in Continental

Europe attendance, from 11.6 million in fiscal 2005 to 11.1 million in fiscal 2006. In the first quarter of fiscal

2006, UK attendances declined by 17.2%, but the trend improved to negative 11.6% in the second quarter, and

returned to growth in the third and fourth quarters, up 0.4% and 7.0%, respectively. In Continental Europe,

attendances increased 6.3% in the first quarter of fiscal 2006 but began a decline in the second quarter, down

7.2%, which continued into the third and fourth quarters, down 7.8% and 10.6%, respectively. In Continental

Europe, we believe that most of the weakness has been the result of ineffective marketing and the resultant lack

of new enrollments for never members. In addition, up until fiscal 2006, Continental Europe saw attendance

growth in every year since fiscal 2000. We believe that the growth of the business outpaced the expertise of the

local management, and we are in the process of strengthening these teams.

Worldwide product sales for fiscal 2006 were $293.3 million, up $7.9 million or 2.8% from $285.4 million

for fiscal 2005. NACO product sales posted strong growth, up 13.2% or $19.0 million to $163.3 million in fiscal

2006. This increase is the result of higher attendance volume coupled with improved penetration of our

in-meeting consumable product offerings. In addition, E-Commerce was launched in the US in late fiscal 2005

and generated $4.8 million of sales in fiscal 2006. Internationally, product sales decreased 7.9% or $11.1 million,

to $130.0 million due primarily to the decline in attendance volume and the negative impact of foreign currency

exchange rates. On a local currency basis, international product sales declined 7.4%.

Online revenues grew $19.7 million or 18.0%, to $129.4 million for fiscal 2006 from $109.7 million for

fiscal 2005, the result of a 15.3% increase in end of period active Weight Watchers Online subscribers, from

399,000 at the end of fiscal 2005 to 460,000 at the end of fiscal 2006. In addition, online advertising revenues

grew $1.5 million or 74.2% to $3.6 million for fiscal 2006.

Other revenue, comprised primarily of licensing revenues and our publications, was $68.3 million for fiscal

2006, an increase of $12.7 million or 22.8%, from $55.6 million for fiscal 2005. Licensing revenues increased

$10.5 million or 27.7% worldwide. The US licensing business grew on the strength of increased distribution of

existing licenses, including ice cream and cakes, while international revenues grew on the strength of both

existing and new licenses. Advertising revenue increased $1.4 million.

Franchise royalties were $12.7 million domestically and $6.5 million internationally for fiscal 2006. Total

franchise royalties of $19.2 million were down 1.0% from $19.4 million in the prior fiscal year. Excluding our

recently acquired franchises, domestic franchise royalties rose 4.1% while international franchise royalties rose

8.2%.

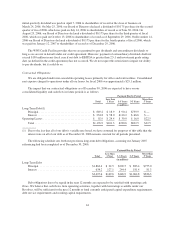

Cost of revenues was $557.1 million for the fiscal 2006, an increase of $36.4 million or 7.0%, from $520.7

million for fiscal 2005. Gross profit margin of 54.8% of sales for fiscal 2006 remained consistent with the prior

year margin.

35