WeightWatchers 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

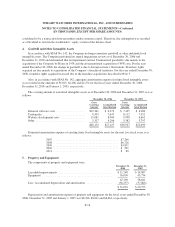

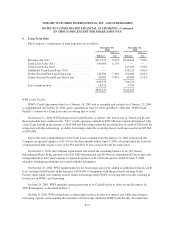

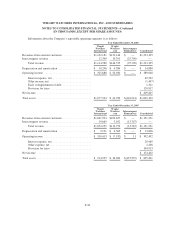

Restricted Stock Units

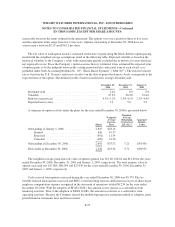

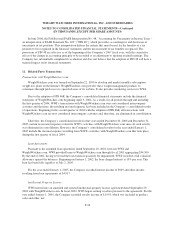

Pursuant to the restricted stock components of the Stock Plans, the Company has granted RSUs to certain

employees. The RSUs vest over a period of three to five years. The fair value of RSUs is determined using the

market price of the Company’s common stock on the date of grant. A summary of RSU activity under the plans

for the year ended December 30, 2006 is presented below:

Shares

Weighted-

Average

Grant-Date

Fair Value

Outstanding at January 1, 2006 ....................................... 181 $48.77

Granted ...................................................... 187 $48.84

Vested ....................................................... (63) $50.29

Forfeited ..................................................... (23) $49.58

Outstanding at December 30, 2006 .................................... 282 $48.40

The weighted-average grant date fair value of RSUs granted was $48.84, $50.26 and $39.01 for the years

ended December 30, 2006, December 31, 2005 and January 1, 2005, respectively. The total fair value of RSUs

vested during the years ended December 30, 2006 and December 31, 2005 was $2,922 and $2,263, respectively.

No RSUs vested during the year ended January 1, 2005.

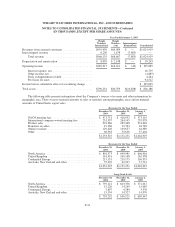

WeightWatchers.com Stock Incentive Plan of Weight Watchers International, Inc. and Subsidiaries:

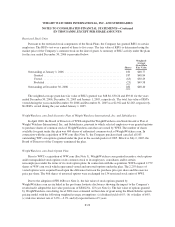

In April 2000, the Board of Directors of WWI adopted the WeightWatchers.com Stock Incentive Plan of

Weight Watchers International, Inc. and Subsidiaries, pursuant to which selected employees were granted options

to purchase shares of common stock of WeightWatchers.com that are owned by WWI. The number of shares

available for grant under this plan was 400 shares of authorized common stock of WeightWatchers.com. In

connection with the acquisition of WW.com (See Note 3), the Company purchased and canceled all 103

outstanding WW.com options granted under the plan in the second quarter of 2005. Effective July 2, 2005, the

Board of Directors of the Company terminated the plan.

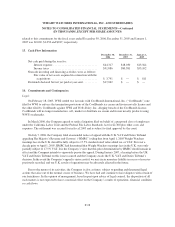

WeightWatchers.com Stock Option Plan

Prior to WWI’s acquisition of WW.com (See Note 3), WeightWatchers.com granted incentive stock options

and/or nonqualified stock options on its common stock to its employees, consultants and/or certain

non-employees under the terms of its stock option plans. In connection with the acquisition, WWI acquired 2,759

shares of WW.com stock which represented vested and unvested options under the plan. The 2,293 shares of

vested options were acquired based upon the difference between the purchase price per share and the exercise

price per share. The 466 shares of unvested options were exchanged for 134 restricted stock units of WWI.

Due to the adoption of FIN 46R (see Note 2), the fair value of stock options granted by

WeightWatchers.com are included in the pro forma footnote disclosures showing the impact to the Company’s

results had it adopted the fair value provisions of SFAS No. 123 (see Note 2). The fair value of options granted

by WeightWatchers.com during fiscal 2004 were estimated on their date of grant using the Black-Scholes option

pricing model with the following weighted average assumptions: (a) dividend yield of 0%, (b) volatility of 64%,

(c) risk-free interest rate of 3.0%—3.9% and (d) expected term of 5 years.

F-23