WeightWatchers 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

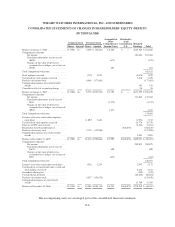

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

considered to be a transaction between entities under common control. Therefore, the redemption was recorded

as a Dividend to Artal in the stockholders’ equity section of the balance sheet.

4. Goodwill and Other Intangible Assets

In accordance with SFAS No. 142, the Company no longer amortizes goodwill or other indefinite lived

intangible assets. The Company performed its annual impairment review as of December 30, 2006 and

December 31, 2005 and determined that no impairment existed. Unamortized goodwill is due mainly to the

acquisition of the Company by Heinz in 1978 and the aforementioned acquisition of WW.com. For the year

ended December 30, 2006, the change in goodwill is due to foreign currency fluctuations. Franchise rights

acquired are due mainly to acquisitions of the Company’s franchised territories. For the year ended December 30,

2006, franchise rights acquired increased due to the franchise acquisitions described in Note 3.

Also, in accordance with SFAS No. 142, aggregate amortization expense for finite lived intangible assets

was recorded in the amounts of $5,025, $4,206 and $2,274 for the fiscal years ended December 30, 2006,

December 31, 2005 and January 1, 2005, respectively.

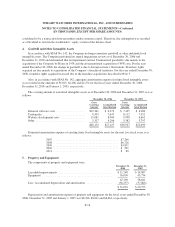

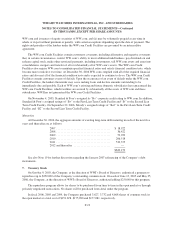

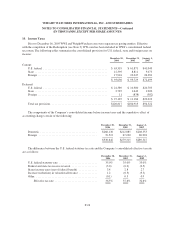

The carrying amount of amortized intangible assets as of December 30, 2006 and December 31, 2005 was as

follows:

December 30, 2006 December 31, 2005

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Deferred software costs .................... $19,361 $ 6,372 $ 7,435 $ 4,280

Trademarks .............................. 8,393 7,647 8,112 7,352

Website development costs ................. 15,081 8,900 9,998 6,661

Other ................................... 5,317 4,206 5,382 3,797

$48,152 $27,125 $30,927 $22,090

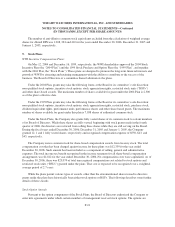

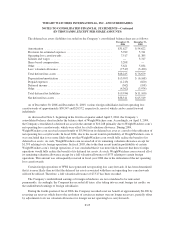

Estimated amortization expense of existing finite lived intangible assets for the next five fiscal years is as

follows:

2007 .............................................. $7,206

2008 .............................................. $6,726

2009 .............................................. $4,871

2010 .............................................. $ 291

2011 .............................................. $ 80

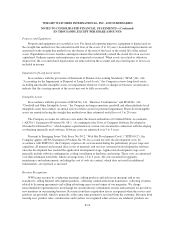

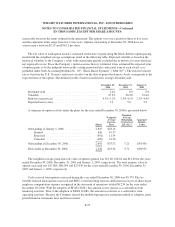

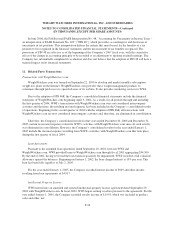

5. Property and Equipment

The components of property and equipment were:

December 30,

2006

December 31,

2005

Leasehold improvements ...................................... $11,240 $ 14,887

Equipment ................................................. 56,050 43,754

67,290 58,641

Less: Accumulated depreciation and amortization .................. (36,257) (37,866)

$ 31,033 $ 20,775

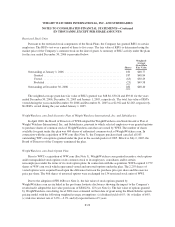

Depreciation and amortization expense of property and equipment for the fiscal years ended December 30,

2006, December 31, 2005 and January 1, 2005 was $8,326, $8,611 and $6,661, respectively.

F-16