WeightWatchers 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sources and Uses of Cash

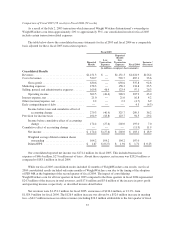

Fiscal 2006

At the end of fiscal 2006, cash and cash equivalents were $37.5 million, an increase of $6.0 million from the

end of fiscal 2005. Cash flows provided by operating activities were $265.8 million, including $37.0 provided by

WeightWatchers.com’s operating activities. The cash provided by operations was driven by our net income of

$209.8 million, changes in our working capital and differences between book and cash taxes. Investing activities

utilized $171.4 million, including $140.4 million for our fiscal 2006 franchise acquisitions and $31.0 million for

capital spending. Net cash used for financing activities totaled $90.9 million, including $151.7 million used to

repurchase 3.6 million shares of our common stock pursuant to our stock repurchase plan, and $51.8 million used

to pay dividends, offset by net proceeds from borrowings of $103.0 million. See Part II, Item 5 of this Annual

Report on Form 10-K for more information regarding our stock repurchase plan.

Fiscal 2005

At the end of fiscal 2005, cash and cash equivalents were $31.5 million, a decrease of $3.7 million from the

end of the fiscal 2004. Cash flows provided by operating activities in fiscal 2005 were $296.8 million. Cash

provided by WeightWatchers.com’s operating activities was $46.2 million. The decrease in cash provided by

operating activities in fiscal 2006 from fiscal 2005 is partially due to a change in the classification of the tax

benefit for stock options and restricted stock units. In fiscal 2005, this benefit was included in cash provided by

operations, but with the adoption of FAS 123(R) in fiscal 2006, this benefit is included in cash provided by

financing activities. Investing activities utilized $400.3 million of cash, including $380.8 million for the

acquisition of the remaining interests in WeightWatchers.com and $19.4 million for capital spending. Net cash

provided for financing activities totaled $103.2 million, comprised of net borrowings of $277.0 million and the

use of $176.0 million for the repurchase of 3.7 million shares of our common stock pursuant to our stock

repurchase plan.

Fiscal 2004

At the end of fiscal 2004, cash and cash equivalents were $35.2 million, an increase of $11.8 million from

the end of fiscal 2003. Cash flows provided by operating activities were $252.4 million and the net use of funds

for investing and financing activities totaled $246.3 million. Investing activities used cash of $65.8 million,

primarily comprised of the $60.5 million cash paid for the acquisitions of our Fort Worth and Washington D.C.

area franchises. Cash used for financing activities totaled $180.4 million, including $177.1 million used to

repurchase 4.7 million of our shares pursuant to our stock repurchase plan. Our pay-down of debt which included

the impact of refinancings that took place in January 2004 and the retirement of the remainder of our 13% Senior

Subordinated Notes in the third quarter of fiscal 2004 were completely offset by a new Term Loan and Revolver

borrowings. In addition, in the first quarter of fiscal 2004, as is required by FIN 46R, we recorded a $5.7 million

net increase in cash as a result of the impact of consolidating WeightWatchers.com.

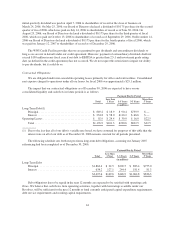

Long-Term Debt

The WWI Credit Facility consists of a term loan, or Term Loan and a revolving line of credit, or Revolver.

The WeightWatchers.com credit facilities consisted of first and second lien term loans, or the WW.com Credit

Facilities. As of December 30, 2006, Weight Watchers International had debt of $663.4 million and had

additional availability under its $500.0 million Revolver of $184.1 million. As of December 30, 2006,

WeightWatchers.com had debt of $185.8 million. Our total debt outstanding was $849.2 million at December 30,

2006 and $746.1 million at December 31, 2005, respectively.

In January 2004, we refinanced the WWI Credit Facility, moving a large portion of our Term Loans to the

Revolver. This provided us with a greater degree of flexibility and the ability to more efficiently manage cash.

Under this refinancing, our Term Loans were reduced from $454.2 million to $150.0 million and our Revolver

capacity was increased from $45.0 million to $350.0 million. To complete the refinancing, we borrowed

$310.0 million under the Revolver.

41