WeightWatchers 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

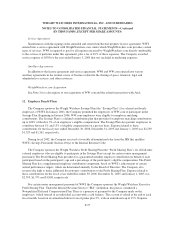

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

related to this commitment for the fiscal years ended December 30, 2006, December 31, 2005 and January 1,

2005 was $2,002, $1,050 and $947, respectively.

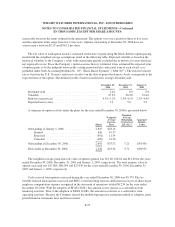

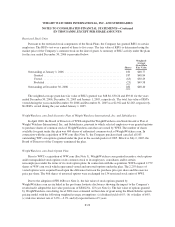

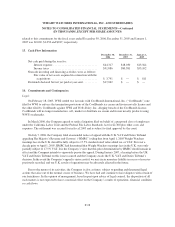

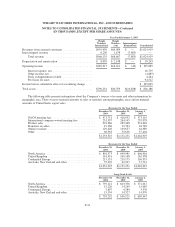

13. Cash Flow Information

December 30,

2006

December 31,

2005

January 1,

2005

Net cash paid during the year for:

Interest expense ............................... $44,317 $18,030 $13,564

Income taxes ................................. $91,886 $80,381 $53,102

Noncash investing and financing activities were as follows:

Fair value of net assets acquired in connection with the

acquisitions ................................ $ 3,741 $ — $ 811

Dividends declared but not yet paid at year-end .......... $17,062 $ — $ —

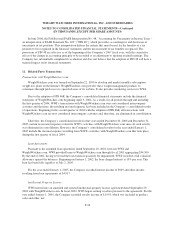

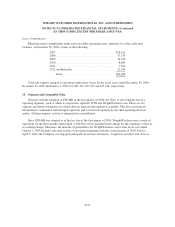

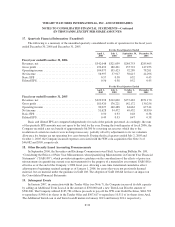

14. Commitments and Contingencies

Legal:

On February 18, 2005, WWI settled two lawsuits with CoolBrands International, Inc. (“CoolBrands”) one

filed by WWI to enforce the termination provisions of the CoolBrands ice cream and frozen novelty license and

the other filed by CoolBrands against WWI and Wells Dairy, Inc. alleging breach of the CoolBrands license.

CoolBrands will no longer manufacture, sell, market or distribute ice cream and frozen novelty products using

WWI’s trademarks.

In March 2006, the Company agreed to settle a litigation filed on behalf of a purported class of employees

under the California Labor Code and the Federal Fair Labor Standards Act for $2,300 plus other costs and

expenses. The settlement was accrued for in fiscal 2005 and is subject to final approval by the court.

On July 7, 2006, the Company filed an amended notice of appeal with the U.K. VAT and Duties Tribunal

appealing Her Majesty’s Revenue and Customs’ (“HMRC”) ruling that from April 1, 2005 Weight Watchers

meetings fees in the U.K. should be fully subject to 17.5% standard rated value added tax, or VAT. For over a

decade prior to April 1, 2005, HMRC had determined that Weight Watchers meetings fees in the U.K. were only

partially subject to 17.5% VAT. It is the Company’s view that this prior determination by HMRC should remain in

effect and the Company intends to vigorously pursue this appeal. During January 2007, a hearing before the UK

VAT and Duties Tribunal on this issue occurred and the Company awaits the U.K. VAT and Duties Tribunal’s

decision. In the event the Company’s appeal is unsuccessful, we may incur monetary liability in excess of reserves

previously recorded, and our U.K. results of operations may be adversely affected in the future.

Due to the nature of its activities, the Company is also, at times, subject to pending and threatened legal

actions that arise out of the normal course of business. We have had and continue to have disputes with certain of

our franchisees. In the opinion of management, based in part upon advice of legal counsel, the disposition of all

such matters is not expected to have a material effect on the Company’s results of operations, financial condition

or cash flows.

F-28