WeightWatchers 2006 Annual Report Download - page 89

Download and view the complete annual report

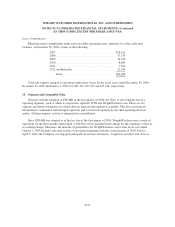

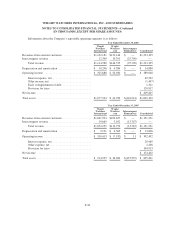

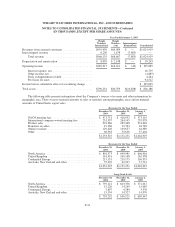

Please find page 89 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

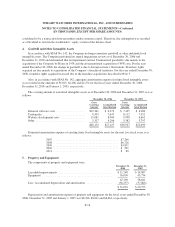

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

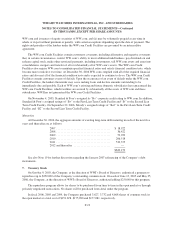

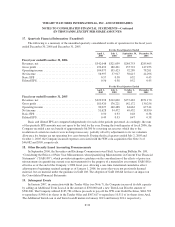

In June 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes –

an interpretation of FASB Statement No. 109” (“FIN 48”), which prescribes accounting for and disclosure of

uncertainty in tax positions. This interpretation defines the criteria that must be met for the benefits of a tax

position to be recognized in the financial statements and the measurement of tax benefits recognized. The

provisions of FIN 48 are effective as of the beginning of the Company’s 2007 fiscal year, with the cumulative

effect of the change in accounting principle to be recorded as an adjustment to opening retained earnings. The

Company has substantially completed its evaluation and does not believe that the adoption of FIN 48 will have a

material impact on its financial statements.

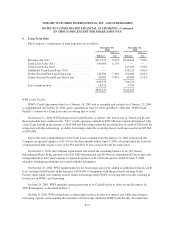

11. Related Party Transactions

Transactions with WeightWatchers.com:

WeightWatchers.com was formed on September 22, 1999 to develop and market monthly subscription

weight loss plans on the Internet. WeightWatchers.com provides these weight management products to

consumers through paid access to specified areas of its website. It also provides marketing services to WWI.

Due to the adoption of FIN 46R, the Company’s consolidated financial statements include the financial

statements of WeightWatchers.com beginning April 3, 2004. As a result, for all periods through and including

the first quarter of 2004, WWI’s transactions with WeightWatchers.com were not considered intercompany

activities and therefore, the resulting income/(expense) has been included in the Company’s consolidated results

of operations. Beginning in the second quarter of 2004 with the adoption of FIN 46R, all transactions with

WeightWatchers.com are now considered intercompany activities and, therefore, are eliminated in consolidation.

Therefore, the Company’s consolidated results for the years ended December 30, 2006 and December 31,

2005 contain no income/(expense) related to WWI’s activities with WeightWatchers.com since all such activity

was eliminated in consolidation. However, the Company’s consolidated results for the year ended January 1,

2005 include the income/(expense) resulting from WWI’s activities with WeightWatchers.com that took place

during the first quarter of fiscal 2004.

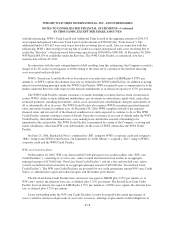

Loan Agreement:

Pursuant to the amended loan agreement, dated September 10, 2001, between WWI and

WeightWatchers.com, WWI provided loans to WeightWatchers.com through fiscal 2001 aggregating $34,500.

By the end of 2001, having reviewed the loan balances quarterly for impairment, WWI recorded a full valuation

allowance against the balances. Beginning on January 1, 2002, the loan charged interest at 13% per year. This

loan has been fully repaid as of July 2, 2005.

For the year ended January 1, 2005, the Company recorded interest income of $949 and other income

resulting from loan repayments of $4,917.

Intellectual Property License:

WWI entered into an amended and restated intellectual property license agreement dated September 29,

2001 with WeightWatchers.com. In fiscal 2002, WWI began earning royalties pursuant to the agreement. For the

year ended January 1, 2005, the Company recorded royalty income of $1,954, which was included in product

sales and other, net.

F-26