WeightWatchers 2006 Annual Report Download - page 49

Download and view the complete annual report

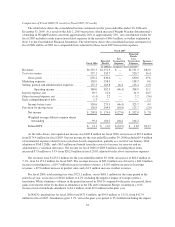

Please find page 49 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketing expenses remained essentially flat, up $0.6 million or 0.4% to $158.9 million for fiscal 2006,

from $158.3 million for fiscal 2005. Marketing expenses in the first quarter of fiscal 2006 declined $7.2 million

or 11.8%, largely the result of timing. Our spring marketing campaign shifted into the second quarter of fiscal

2006 because of a three-week late Easter holiday, April 16th this year versus March 27th last year. In addition, the

U.K.’s marketing expense was more front-loaded in fiscal 2005 for the launch of the Switch innovation.

Furthermore, our fiscal 2006 and fiscal 2007 international winter diet season direct mail expense was incurred in

the fourth quarter of fiscal 2005, and fiscal 2006, respectively. In fiscal 2005, our winter diet season direct mail

expense was incurred in the first quarter of fiscal 2005, when mailed. For the remainder of fiscal 2006, marketing

expenses increased $7.8 million or 8.1%. The higher spending on marketing in the remainder of the year was

partially due to the timing of Easter, as mentioned above, and in support of the newly acquired territories coupled

with increased offline advertising to support the WeightWatchers.com business. Marketing, as a percentage of

revenues declined to 12.9% for fiscal 2006, as compared to 13.7% in the prior year.

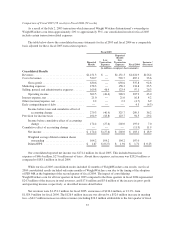

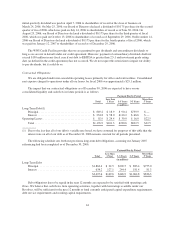

Selling, general and administrative expenses were $137.3 million for fiscal 2006 as compared to $169.8

million for fiscal 2005, a decrease of $32.5 million or 19.1%. Fiscal 2005 selling, general and administrative

expenses included $46.4 million of transaction-related expenses. Excluding these transaction-related expenses

from fiscal 2005, selling, general and administrative expenses were up $13.9 million, or 11.3% for fiscal 2006

versus the comparable adjusted prior year period. Approximately $9.4 million of the increase in selling, general

and administrative expenses is attributable to higher non-cash share-based compensation expense, the majority of

which is due to the expensing of stock options in accordance with FAS 123(R), which was adopted at the

beginning of fiscal 2006. Selling, general and administrative expenses were 11.1% of revenues for fiscal 2006

including the impact of incremental non-cash share-based compensation, as compared to 10.7% in fiscal 2005

after eliminating transaction expenses from that period. On a reported basis, selling, general and administrative

expenses were 14.7% of revenues in fiscal 2005.

Operating income was $380.0 million for fiscal 2006, an increase of $77.5 million or 25.6%, from $302.5

million for fiscal 2005. The operating income margin for fiscal 2006 was 30.8%, as compared to 26.3% for the

prior year. Excluding transaction-related expenses in fiscal 2005 due to the WeightWatchers.com acquisition,

operating income increased $31.1 million, or 8.9%, from $348.9 million for fiscal 2005. On a comparable basis,

the operating income margin improved 50 basis points from 30.3% in the prior year to 30.8% in the current year.

Net interest charges increased $28.5 million to $49.5 million for fiscal 2006, as compared to $21.0 million

for fiscal 2005. Our average debt outstanding rose $341.8 million from the December 2005 level. At the end of

fiscal 2005, WeightWatchers.com put in place credit facilities of $215 million, at a higher interest rate than our

previously existing debt, as the final stage of its acquisition by Weight Watchers International. The remaining

increase in our average debt outstanding was due to share repurchases and the reactivation of our franchise

acquisition program. Our effective interest rate rose from 4.94% for fiscal 2005, to 6.48% for fiscal 2006.

For fiscal 2006, we reported other income of $1.4 million as compared to other expense of $2.2 million in

fiscal 2005. The $3.6 million increase is primarily the result of foreign currency fluctuations on intercompany

transactions.

In connection with the early extinguishment of debt resulting from the 2006 refinancing of the WWI Credit

Facility, we recorded a charge of $1.3 million relating to the write-off of a portion of the deferred financing costs

associated with our old debt.

Our effective tax rate for fiscal 2006 was 36.5%, as compared to 37.6% for fiscal 2005. In fiscal 2006, we

recognized a net tax benefit of $6.3 million by reversing tax reserves which due to the resolution of certain tax

matters, were no longer necessary, partially offset by adjustments to our tax valuation allowance for foreign tax

net operating loss carryforwards.

36