WeightWatchers 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Statements” (“SAB 108”), which provides interpretive guidance on the consideration of the effects of prior year

misstatements in quantifying current year misstatements for the purpose of a materiality assessment. SAB 108 is

effective as of the end of our 2006 fiscal year, allowing a one-time transitional cumulative effect adjustment to

beginning retained earnings as of January 1, 2006, for errors that were not previously deemed material, but are

material under the guidance in SAB 108. The adoption of SAB 108 did not have a material impact on our

Consolidated Financial Statements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to foreign currency fluctuations and interest rate changes. Our exposure to market risk for

changes in interest rates relates to interest expense of variable rate debt. Due to the repurchase and retirement of

the remaining balance of our 13% Senior Subordinated Notes in 2004, we no longer have any fixed rate

borrowings outstanding at December 30, 2006. Therefore, market interest rates no longer affect the fair value of

our long-term debt balances. Since 100% of our debt is now variable rate based, any changes in market interest

rates will cause an equal change in our net interest expense.

Other than inter-company transactions between our domestic and foreign entities, we generally do not have

significant transactions that are denominated in a currency other than the functional currency applicable to each

entity. From time to time we may enter into forward and swap contracts to hedge transactions denominated in

foreign currencies to reduce the currency risk associated with fluctuating exchange rates. Realized and unrealized

gains and losses from any of these transactions may be included in net income for the period.

In addition, we enter into interest rate swaps to hedge a substantial portion of our variable rate debt.

Changes in the fair value of these derivatives will be recorded each period in earnings for non-qualifying

derivatives or accumulated other comprehensive income (loss) for qualifying derivatives.

Fluctuations in currency exchange rates may impact our shareholders’ equity. The assets and liabilities of

our non-U.S. subsidiaries are translated into U.S. dollars at the exchange rates in effect at the balance sheet date.

Revenues and expenses are translated into U.S. dollars at the weighted average exchange rate for the period. The

resulting translation adjustments are recorded in shareholders’ equity as accumulated other comprehensive

income (loss). In addition, fluctuations in the value of the euro will cause the U.S. dollar translated amounts to

change in comparison to prior periods.

Each of our subsidiaries, other than WeightWatchers.com, derives revenues and incurs expenses primarily

within a single country and, consequently, does not generally incur currency risks in connection with the conduct

of normal business operations.

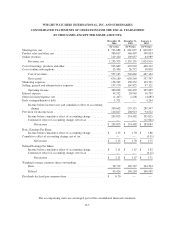

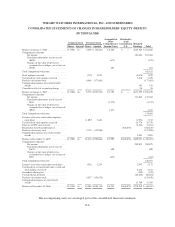

Item 8. Financial Statements and Supplementary Data

This information is incorporated by reference to the “Consolidated Financial Statements and Notes” on

pages F-1 through F-32, including the report thereon of PricewaterhouseCoopers LLP on page F-2.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be

disclosed in our reports under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is

recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange

47