WeightWatchers 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends

On February 16, 2006, our Board of Directors authorized the initiation of a quarterly cash dividend of

$0.175 per share of our outstanding common stock, which corresponds to an annual dividend rate of $0.70 per

share. The initial quarterly dividend was paid on April 7, 2006 to shareholders of record at the close of business

on March 24, 2006. On May 25, 2006, our Board of Directors declared a dividend of $0.175 per share for the

second quarter of fiscal 2006, which was paid on July 14, 2006 to shareholders of record as of June 30, 2006. On

August 29, 2006, our Board of Directors declared a dividend of $0.175 per share for the third quarter of fiscal

2006, which was paid on October 13, 2006 to shareholders of record as of September 29, 2006. On December 14,

2006 our Board of Directors declared a dividend of $0.175 per share for the fourth quarter of fiscal 2006, which

was paid on January 12, 2007 to shareholders of record as of December 29, 2006. Prior to these dividends, we

had not declared or paid any cash dividends on our common stock since our acquisition by Artal in 1999.

Any decision to declare and pay dividends in the future will be made at the discretion of our Board of

Directors, after taking into account our financial results, capital requirements and other factors they may deem

relevant. Our Board of Directors may decide at any time to decrease the amount of dividends or discontinue the

payment of dividends based on these factors. The WWI Credit Facility also contains restrictions on our ability to

pay dividends on our common stock. See “Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations—Liquidity and Capital Resources—Dividends” for a description of the

WWI Credit Facility and these restrictions.

Securities Authorized for Issuance Under Equity Compensation Plans

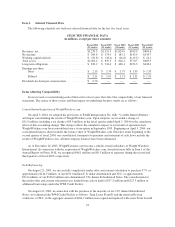

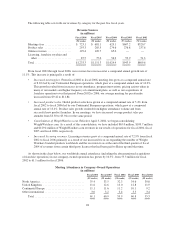

The following table summarizes our equity compensation plan information as of December 30, 2006:

Equity Compensation Plan Information

Plan category

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights(1)

Weighted average

exercise price of

outstanding options,

warrants and rights(2)

Number of securities

remaining available

for future issuance

Equity compensation plans approved by security

holders ................................ 2,923,156 $30.29 1,729,519

Equity compensation plans not approved by

security holders ......................... — — —

Total .................................... 2,923,156 $30.29 1,729,519

(1) Consists of 2,641,347 shares of our common stock issuable upon the exercise of outstanding options and

281,809 shares of our common stock issuable upon the vesting of restricted stock units awarded under our

2004 Stock Incentive Plan and our 1999 Stock Purchase and Option Plan.

(2) Includes weighted average exercise price of stock options outstanding of $33.52 and restricted stock units of

$0.

23