WeightWatchers 2006 Annual Report Download - page 77

Download and view the complete annual report

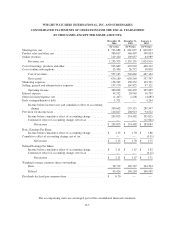

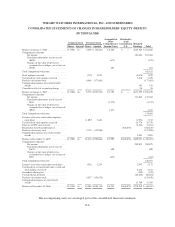

Please find page 77 of the 2006 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

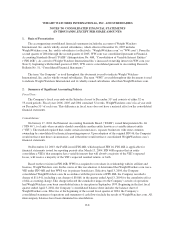

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

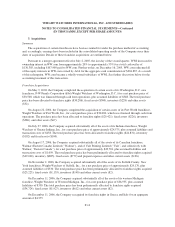

3. Acquisitions

Summary

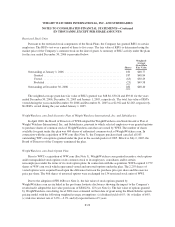

The acquisitions of certain franchisees have been accounted for under the purchase method of accounting

and, accordingly, earnings have been included in the consolidated operating results of the Company since their

dates of acquisition. Details of these franchise acquisitions are outlined below.

Pursuant to a merger agreement effective July 2, 2005, the last day of the second quarter, WWI increased its

ownership interest in WW.com from approximately 20% to approximately 53% for a total cash outlay of

$136,385, including $107,900 paid to WW.com. Further to this, on December 16, 2005, WW.com redeemed all

of the equity interests in WW.com owned by Artal for the aggregate cash consideration of $304,835. As a result

of this redemption, WW.com became a wholly-owned subsidiary of WWI. See further discussion below for the

accounting treatment of this transaction.

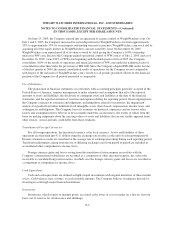

Franchise Acquisitions

On May 9, 2004, the Company completed the acquisition of certain assets of its Washington, D.C. area

franchisee, F-W Family Corporation (d/b/a Weight Watchers of Washington, D.C.) for a net purchase price of

$30,500, which was financed through cash from operations, plus assumed liabilities of $348. The total purchase

price has been allocated to franchise rights ($30,286), fixed assets ($300), inventory ($228) and other assets

($52).

On August 22, 2004, the Company completed the acquisition of certain assets of its Fort Worth franchisee,

Weight Watchers of Fort Worth, Inc., for a net purchase price of $30,000, which was financed through cash from

operations. The purchase price has been allocated to franchise rights ($29,421), fixed assets ($226), inventory

($286), and other assets ($67).

On July 27, 2006, the Company acquired substantially all of the assets of its Indiana franchisee, Weight

Watchers of Greater Indiana, Inc., for a net purchase price of approximately $24,575, plus assumed liabilities and

transaction costs of $458. The total purchase price has been allocated to franchise rights ($24,831), inventory

($102) and fixed assets ($100).

On August 17, 2006, the Company acquired substantially all of the assets of its Canadian franchisee,

Walmar (Eastern Canada) Limited (“Walmar”), and of Vale Printing Limited (“Vale”, and collectively with

Walmar, “Eastern Canada”), for a net purchase price of approximately $49,781, plus assumed liabilities and

transaction costs of $1,059. The total purchase price has been preliminarily allocated to franchise rights acquired

($49,040), inventory ($885), fixed assets ($779) and prepaid expenses and other current assets ($136).

On November 2, 2006, the Company acquired substantially all of the assets of its Suffolk County, New

York franchisee, Weight Watchers of Suffolk, Inc., for a net purchase price of approximately $24,170, plus

assumed liabilities of $330. The total purchase price has been preliminarily allocated to franchise rights acquired

($23,225), fixed assets ($1,133), inventory ($140) and other current assets ($2).

On December 11, 2006, the Company acquired substantially all of the assets of its western Michigan

franchise, Weight Watchers of Western Michigan, Inc., for a net purchase price of $36,935, plus assumed

liabilities of $330. The total purchase price has been preliminarily allocated to franchise rights acquired

($34,724), fixed assets ($1,927), inventory ($612) and other current assets ($2).

On December 11, 2006, the Company reacquired its franchise rights in Greece and Italy for an aggregate

amount of $4,375.

F-14