WeightWatchers 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

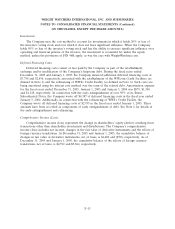

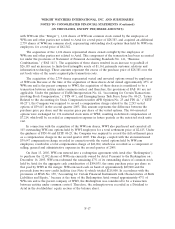

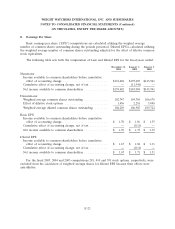

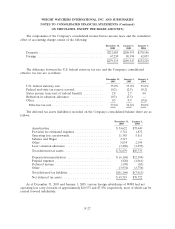

5. Property and Equipment

The components of property and equipment were:

December 31, January 1,

2005 2005

Leasehold improvements ................................. $14,887 $ 10,984

Equipment ........................................... 43,754 39,870

58,641 50,854

Less: Accumulated depreciation and amortization ............... (37,866) (33,374)

$20,775 $ 17,480

Depreciation and amortization expense of property and equipment for the fiscal years ended

December 31, 2005, January 1, 2005 and January 3, 2004 was $7,808 (including $1,052 for depreciation

of assets of WeightWatchers.com), $6,661 (including $1,088 for depreciation of assets of

WeightWatchers.com) and $4,832, respectively.

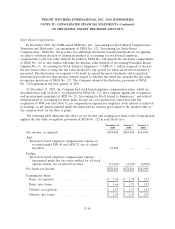

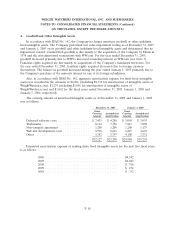

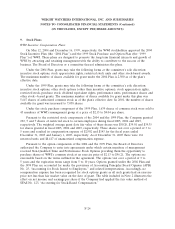

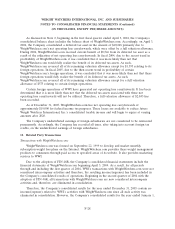

6. Long-Term Debt

The Company’s components of long-term debt are as follows:

December 31, 2005 January 1, 2005

Effective Effective

Balance rate Balance rate

Revolver due 2009 ......................... $236,000 5.22% $171,000 3.24%

Term Loan B due 2010 ...................... 147,000 5.04% 148,500 3.24%

Additional Term Loan B due 2010 .............. 148,125 4.81% 149,625 3.60%

Senior Secured First Lien Term Loan ........... 170,000 6.62% —

Senior Secured Second Lien Term Loan .......... 45,000 9.12% —

746,125 469,125

Less Current Portion ....................... 4,700 3,000

$741,425 $466,125

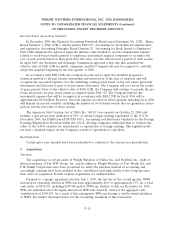

Credit Facility

WWI’s Credit Agreement dated as of January 16, 2001 and as amended and restated as of

December 21, 2001, April 1, 2003, August 21, 2003, January 21, 2004 and October 19, 2004 (the

‘‘Credit Facility’’) consists of Term Loans and a revolving line of credit (‘‘the Revolver.’’)

On January 21, 2004, WWI refinanced its Credit Facility as follows: the Term Loan A, Term Loan

B, and the transferable loan certificate (the ‘‘TLC’’) in the aggregate amount of $454,180 were repaid

and replaced with a new Term Loan B in the amount of $150,000 and borrowings under the Revolver

of $310,000. In connection with this refinancing, available borrowings under the Revolver increased

F-19