WeightWatchers 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

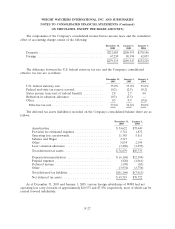

Derivative Instruments and Hedging:

Prior to the extinguishment of the Euro Notes (as described in Note 6), the Company entered into

forward and swap contracts to hedge transactions denominated in foreign currencies to reduce currency

risk associated with fluctuating exchange rates. These contracts were used primarily to hedge certain

foreign currency cash flows and for payments arising from those foreign currency denominated debt

obligations. The Company currently enters into interest rate swaps to hedge a substantial portion of its

variable rate debt. These contracts are used primarily to reduce the risk associated with variable

interest rate debt obligations. As of December 31, 2005, the Company held contracts to purchase

interest rate swaps with notional amounts totaling $257,500 and to sell interest rate swaps with notional

amounts totaling $257,500. As of January 1, 2005, the Company held contracts to purchase interest rate

swaps with notional amounts totaling $150,000 and to sell interest rate swaps with notional amounts

totaling $150,000. The Company is hedging forecasted transactions for periods not exceeding the next

three years. At December 31, 2005, given the current configuration of its debt, the Company estimates

that no derivative gains or losses reported in accumulated other comprehensive income (loss) will be

reclassified to the Statement of Operations within the next twelve months.

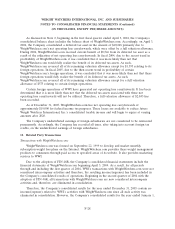

As of December 31, 2005 and January 1, 2005, cumulative losses for qualifying hedges were

reported as a component of accumulated other comprehensive income(loss) in the amount of $1,402

($2,300 before taxes) and $(70) ($(115) before taxes), respectively. The Company discontinued certain

of its cash flow hedges that were associated with the euro denominated Notes that were extinguished,

as described in Note 6. As such, in fiscal 2003, the Company reclassified a net loss of $5,381 from

accumulated other comprehensive income to other expense, net. In addition, the Company recorded

net proceeds of $2,710 from the gain on settlement in cash from financing activities in the Statement of

Cash Flows as cash flows from hedge transactions are classified in a manner consistent with the item

being hedged. The ineffective portion of changes in fair values of qualifying cash flow hedges was not

material. Prior to the extinguishment of the euro denominated Notes, the Company hedged 24% of the

outstanding principal of the euro Notes via forward contracts, subsequent to the extinguishment, but

prior to the repurchase of the remaining Notes, the Company was 100% hedged. As such, to offset

gains or losses from changes in foreign exchange rates related to the euro denominated Notes for the

fiscal years ended January 1, 2005 and January 3, 2004, the Company reclassified $6 ($9 before taxes)

and $310 ($508 before taxes) from accumulated other comprehensive income (loss) to other expense,

net.

For the fiscal year ended January 1, 2005 fair value adjustments for non-qualifying hedges resulted

in a reduction to net income of $798 ($1,309 before taxes), included within other expense, net.

F-35