WeightWatchers 2005 Annual Report Download - page 41

Download and view the complete annual report

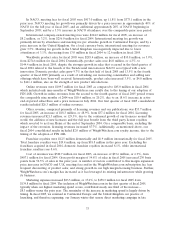

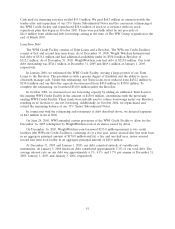

Please find page 41 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As discussed above, WeightWatchers.com is now a wholly-owned subsidiary of Weight Watchers

International. Therefore, we consolidate 100% of the results of WeightWatchers.com under the

traditional rules of consolidation rather than under the provisions of FIN 46R. Since we adopted FIN

46R on the last day of the first quarter of fiscal 2004, commencing in the second quarter of fiscal 2005

and forward, our quarterly consolidated results are comparable with respect to the inclusion of

WeightWatchers.com’s results.

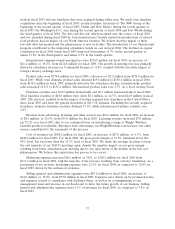

Income Taxes

Deferred income taxes result primarily from temporary differences between financial and tax

reporting. If it is more likely than not that some portion of a deferred tax asset will not be realized, a

valuation allowance is recognized. We consider historic levels of income, estimates of future taxable

income and feasible tax planning strategies in assessing the need for a tax valuation allowance. We also

establish an appropriate level of additional provisions for income taxes in the event that certain

positions, which we believe are fully supportable, are challenged by the tax authorities. We adjust these

additional provisions in light of changing facts and circumstances. If our filing positions are ultimately

upheld under audits by respective taxing authorities, the provision for income taxes in future years will

reflect favorable adjustments.

Capitalized Software Development

We follow the provisions of AICPA Statement of Position 98-1, ‘‘Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use’’, or SOP 98-1, which requires the

capitalization of certain costs incurred in connection with developing or obtaining software for internal

use. These costs are amortized to cost of revenue over a period of three years, the estimated useful life

of the software. We periodically evaluate for impairment capitalized software development costs by

considering, among other factors, whether the software is still expected to provide substantive service

potential, and whether a significant change is being made or will be made to the software.

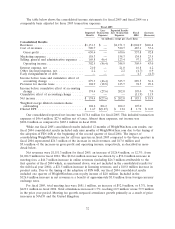

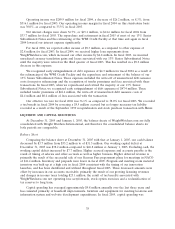

Weight Watchers International Results of Operations

As explained above under ‘‘—Critical Accounting Policies,’’ since April 3, 2004, we have

consolidated WeightWatchers.com, initially pursuant to FIN 46R and beginning with the second quarter

of fiscal 2005, pursuant to Accounting Research Bulletin No. 51, ‘‘Consolidated Financial Statements’’

as a result of our increased ownership interest in WeightWatchers.com.

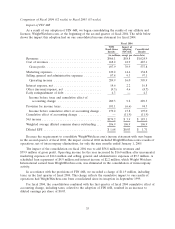

Comparison of Fiscal 2005 (52 weeks) to Fiscal 2004 (52 weeks)

As a result of the July 2, 2005 transaction which increased Weight Watchers International’s

ownership in WeightWatchers.com from approximately 20% to approximately 53%, our consolidated

results for fiscal 2005 include certain transaction-related expenses.

31