WeightWatchers 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

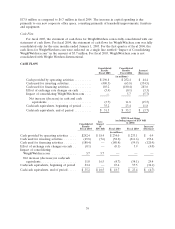

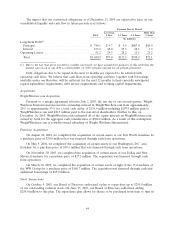

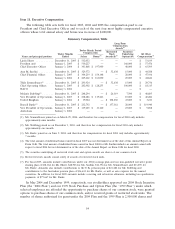

The impact that our contractual obligations as of December 31, 2005 are expected to have on our

consolidated liquidity and cash flow in future periods is as follows:

Payment Due by Period

Less than More than

Total 1 Year 1-3 Years 3-5 Years 5 Years

(in millions)

Long-Term Debt(1)

Principal ............................. $ 746.1 $ 4.7 $ 9.4 $687.0 $45.0

Interest .............................. 193.6 48.0 95.3 48.4 1.9

Operating Leases ......................... 91.2 24.3 28.2 13.5 25.2

Total ................................ $1,030.9 $77.0 $132.9 $748.9 $72.1

(1) Due to the fact that all of our debt is variable rate based, we have assumed for purposes of this table that the

interest rate on all of our debt as of December 31, 2005 remains constant for all periods presented.

Debt obligations due to be repaid in the next 12 months are expected to be satisfied with

operating cash flows. We believe that cash flows from operating activities, together with borrowings

available under our Revolver, will be sufficient for the next 12 months to fund currently anticipated

capital expenditure requirements, debt service requirements and working capital requirements.

Acquisitions

WeightWatchers.com Acquisition

Pursuant to a merger agreement effective July 2, 2005, the last day of our second quarter, Weight

Watchers International increased its ownership interest in WeightWatchers.com from approximately

20% to approximately 53% for a total cash outlay of $136.4 million including $107.9 million paid to

WeightWatchers.com and $28.5 million paid to the non-Artal shareholders. Further to this, on

December 16, 2005, WeightWatchers.com redeemed all of the equity interests in WeightWatchers.com

owned by Artal for the aggregate cash consideration of $304.8 million. As a result of this redemption,

WeightWatchers.com is a wholly-owned subsidiary of Weight Watchers International.

Franchise Acquisitions

On August 22, 2004, we completed the acquisition of certain assets of our Fort Worth franchise for

a purchase price of $30.0 million that was financed through cash from operations.

On May 9, 2004, we completed the acquisition of certain assets of our Washington, D.C. area

franchise for a purchase price of $30.5 million that was financed through cash from operations.

On November 30, 2003, we completed the acquisition of certain assets of our Dallas and New

Mexico franchises for a purchase price of $27.2 million. The acquisition was financed through cash

from operations.

On March 30, 2003, we completed the acquisition of certain assets of eight of the 15 franchises of

the WW Group for a purchase price of $180.7 million. The acquisition was financed through cash and

additional borrowings of $85.0 million.

Stock Transactions

On October 9, 2003, our Board of Directors authorized a plan to repurchase up to $250.0 million

of our outstanding common stock. On June 13, 2005, our Board of Directors authorized adding

$250.0 million to this plan. The repurchase plan allows for shares to be purchased from time to time in

44