WeightWatchers 2005 Annual Report Download - page 86

Download and view the complete annual report

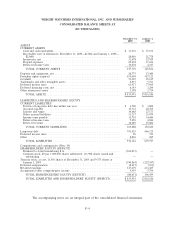

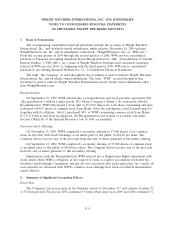

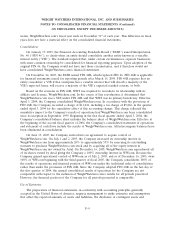

Please find page 86 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

liabilities at the date of the financial statements, and the reported amounts of revenues and expenses

during the reporting period. On an ongoing basis, the Company evaluates its estimates and judgments,

including those related to inventories, the impairment analysis for goodwill and other indefinite-lived

intangible assets, income taxes, and contingencies and litigation. The Company bases its estimates on

historical experience and on various other factors and assumptions that it believes to be reasonable

under the circumstances, the results of which form the basis for making judgments about the carrying

values of assets and liabilities that are not readily apparent from other sources. Actual amounts could

differ from these estimates.

Translation of Foreign Currencies:

For all foreign operations, the functional currency is the local currency. Assets and liabilities of

these operations are translated into U.S. dollars using the exchange rate in effect at the end of each

reporting period. Income statement accounts are translated at the average rate of exchange prevailing

during each reporting period. Translation adjustments arising from the use of differing exchange rates

from period to period are included in accumulated other comprehensive income (loss).

Foreign currency gains and losses arising from the translation of intercompany receivables with the

Company’s international subsidiaries are recorded as a component of other (income)/expense, net,

unless the receivable is considered long-term in nature, in which case the foreign currency gains and

losses are recorded as a component of other comprehensive income (loss).

Cash Equivalents:

Cash and cash equivalents are defined as highly liquid investments with original maturities of three

months or less. Cash balances may, at times, exceed insurable amounts. The Company believes it

mitigates this risk by investing in or through major financial institutions.

Inventories:

Inventories, which consist of finished goods, are stated at the lower of cost or market on a first-in,

first-out basis, net of reserves for obsolescence and shrinkage.

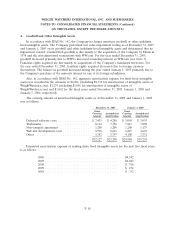

Property and Equipment:

Property and equipment are recorded at cost. For financial reporting purposes, equipment is

depreciated on the straight-line method over the estimated useful lives of the assets (3 to 10 years).

Leasehold improvements are amortized on the straight-line method over the shorter of the term of the

lease or the useful life of the related assets. Expenditures for new facilities and improvements that

substantially extend the useful life of an asset are capitalized. Ordinary repairs and maintenance are

expensed as incurred. When assets are retired or otherwise disposed of, the cost and related

depreciation are removed from the accounts and any related gains or losses are included in income.

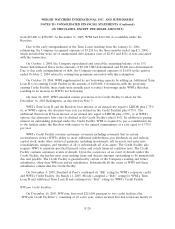

Impairment of Long Lived Assets:

In accordance with the provisions of Statement of Financial Accounting Standards (‘‘SFAS’’)

No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived Assets,’’ the Company reviews

long-lived assets, including amortizable intangible assets, for impairment whenever events or changes in

business circumstances indicate that the carrying amount of the assets may not be fully recoverable.

F-10