WeightWatchers 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

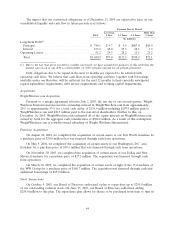

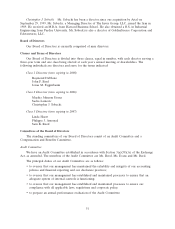

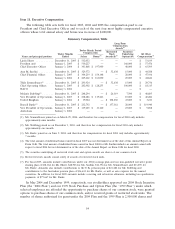

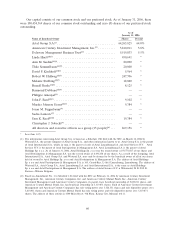

Item 11. Executive Compensation

The following table sets forth for fiscal 2005, 2004 and 2003 the compensation paid to our

President and Chief Executive Officer and to each of the next four most highly compensated executive

officers whose total annual salary and bonus was in excess of $100,000.

Summary Compensation Table

Long-Term

Compensation

Awards(5)

Twelve Month Period Restricted Securities

Compensation

Twelve Months Stock Underlying All Other

Name and principal position Ended Salary Bonus(4) Awards($)(6) Options(#) Compensation(7)

Linda Huett ........... December 31, 2005 $ 532,052 — — — $ 53,109

President and January 1, 2005 $ 510,227 — — 160,000 $ 57,476

Chief Executive Officer January 3, 2004 $ 301,868 $ 197,000 — 40,000 $ 65,509

Ann M. Sardini ......... December 31, 2005 $ 329,572 — $ 52,638 15,000 $ 44,588

Chief Financial Officer January 1, 2005 $ 304,219 $ 154,148 — 20,000 $ 47,936

January 3, 2004 $ 245,662 $ 161,000 — 20,000 $ 44,844

Thilo Semmelbauer(1) ..... December 31, 2005 $ 291,924 — $ 52,638 15,000 $ 29,756

Chief Operating Officer, January 1, 2005 $ 202,902 $ 128,255 — 100,000 $ 18,315

NACO January 3, 2004 — — — — $ —

Melanie Stubbing(2) ....... December 31, 2005 $ 248,294 — $ 26,319 7,500 $ 40,805

Vice President of Operations, January 1, 2005 $ 238,486 $ 119,243 — 10,000 $ 40,286

United Kingdom January 3, 2004 $ 19,024 — $ 108,030 47,000 $ 3,213

Russell Burke(3) ......... December 31, 2005 $ 232,792 — $ 157,381 20,000 $ 119,940

Vice President of Operations, January 1, 2005 $ 119,425 $ 13,140 — 25,000 $ 9,898

Australasia January 3, 2004 — — — — —

(1) Mr. Semmelbauer joined us on March 29, 2004, and therefore his compensation for fiscal 2004 only includes

approximately nine months.

(2) Ms. Stubbing joined us on December 1, 2003, and therefore her compensation for fiscal 2003 only includes

approximately one month.

(3) Mr. Burke joined us on June 9, 2004, and therefore his compensation for fiscal 2004 only includes approximately

7 months.

(4) The total amount of individual bonus earned in fiscal 2005 was not determined as of the date of this Annual Report on

Form 10-K. The total amount of individual bonus earned in fiscal 2004 for Ms. Sardini includes an amount earned with

respect to fiscal 2004 but not determined as of the date of the Annual Report on Form 10-K for fiscal 2004.

(5) The securities underlying all restricted stock unit and option awards are shares of our common stock.

(6) Restricted stock awards consist solely of awards of restricted stock units.

(7) For fiscal 2005, amounts include contributions under our 401(k) savings plan and our non-qualified executive profit

sharing plan of $38,184 for Ms. Huett, $28,903 for Ms. Sardini, $16,556 for Mr. Semmelbauer and $13,039 for

Mr. Burke. Amounts also include contributions to the U.K. pension plan of $21,282 for Ms. Stubbing and

contributions to the Australian pension plan of $16,632 for Mr. Burke, as well as auto expense for the named

executives. In addition, for fiscal 2005 amounts include a moving and relocation allowance, including tax equalization

payments, of $77,667 for Mr. Burke.

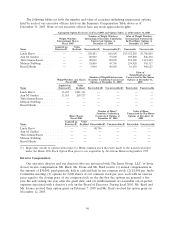

In May 2004 and December 1999, respectively, our stockholders approved our 2004 Stock Incentive

Plan (the ‘‘2004 Plan’’) and our 1999 Stock Purchase and Option Plan (the ‘‘1999 Plan’’) under which

selected employees are afforded the opportunity to purchase shares of our common stock, were granted

options to purchase shares of our common stock, and/or received grants of restricted stock units. The

number of shares authorized for grant under the 2004 Plan and the 1999 Plan is 2,500,000 shares and

54