WeightWatchers 2005 Annual Report Download - page 84

Download and view the complete annual report

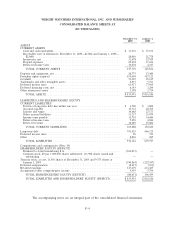

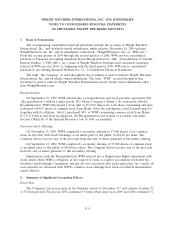

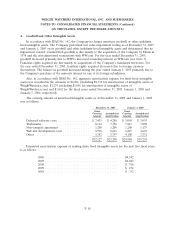

Please find page 84 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

1. Basis of Presentation

The accompanying consolidated financial statements include the accounts of Weight Watchers

International, Inc., and its wholly-owned subsidiaries, which effective December 16, 2005 includes

WeightWatchers.com, Inc. and its subsidiaries (collectively, ‘‘WeightWatchers.com’’ or ‘‘WW.com’’).

From the second quarter of 2004 through the second quarter of 2005, WW.com was consolidated

pursuant to Financial Accounting Standards Board Interpretation No. 46R, ‘‘Consolidation of Variable

Interest Entities’’ (‘‘FIN 46R’’). As a result of Weight Watchers International’s increased ownership

interest in WW.com (see Note 2), beginning with the third quarter 2005, WW.com is consolidated

pursuant to Accounting Research Bulletin No. 51, ‘‘Consolidated Financial Statements.’’

The term ‘‘the Company’’ as used throughout this document is used to indicate Weight Watchers

International, Inc. and its wholly owned subsidiaries. The term ‘‘WWI’’ as used throughout this

document is used to indicate Weight Watchers International and its wholly-owned subsidiaries other

than WeightWatchers.com.

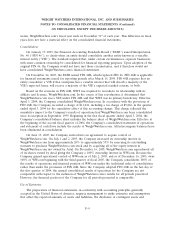

Recapitalization:

On September 29, 1999, WWI entered into a recapitalization and stock purchase agreement (the

‘‘Recapitalization’’) with its former parent, H.J. Heinz Company (‘‘Heinz’’). In connection with the

Recapitalization, WWI effectuated a stock split of 58,747.6 shares for each share outstanding and then

redeemed 164,442 shares of common stock from Heinz. After the redemption, Artal Luxembourg S.A.

(together with its affiliates, ‘‘Artal’’) purchased 94% of WWI’s remaining common stock from Heinz.

For U.S. Federal and State tax purposes, the Recapitalization was treated as a taxable sale under

Section 338(h)(10) of the Internal Revenue Code of 1986, as amended.

Secondary Stock Offerings:

On November 15, 2001, WWI completed a secondary offering of 17,400 shares of its common

stock on the New York Stock Exchange at an initial price to the public of $24.00 per share. The

Company did not receive any of the proceeds from the sale of shares pursuant to the public offering.

On September 23, 2002, WWI completed a secondary offering of 15,000 shares of common stock

at an initial price to the public of $42.00 per share. The Company did not receive any of the proceeds

from the sale of shares pursuant to this secondary offering.

Simultaneous with the Recapitalization, WWI entered into a Registration Rights Agreement with

Artal, under which WWI is obligated, at the request of Artal, to register its common stock with the

Securities and Exchange Commission and pay all costs associated with such registration. As a result, all

costs incurred in connection with WWI’s common stock offerings have been recorded in shareholders’

equity (deficit).

2. Summary of Significant Accounting Policies

Fiscal Year:

The Company’s fiscal year ends on the Saturday closest to December 31st and consists of either 52

or 53-week periods. Fiscal year 2003 contained 53 weeks while fiscal years 2005 and 2004 contained 52

F-8