WeightWatchers 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

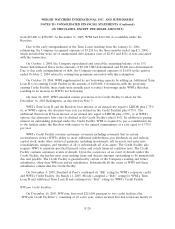

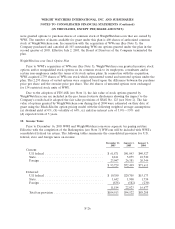

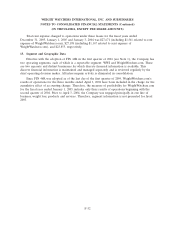

As discussed in Note 2, beginning in the first fiscal quarter ended April 3, 2004, the Company’s

consolidated balance sheet includes the balance sheet of WeightWatchers.com. Accordingly, on April 3,

2004, the Company consolidated a deferred tax asset in the amount of $10,248 primarily due to

WeightWatchers.com’s net operating loss carryforwards, which were offset by a full valuation allowance.

During 2004, WeightWatchers.com received current benefit of $5,546 from its deferred tax asset as a

result of the utilization of net operating loss carryforwards. In fiscal 2004, due to the recent trend in

profitability of WeightWatchers.com, it was concluded that it was more likely than not that

WeightWatchers.com would fully realize the benefit of its deferred tax assets. As such,

WeightWatchers.com reversed all of its remaining valuation allowance except for $1,593 relating to its

foreign operations. In fiscal 2005, due to the then recent trend in profitability of certain

WeightWatchers.com’s foreign operations, it was concluded that it was more likely than not that these

foreign operations would fully realize the benefit of its deferred tax assets. As such,

WeightWatchers.com reversed all of its remaining valuation allowance except for a full valuation

allowance of $575 relating to certain foreign operations.

Certain foreign operations of WWI have generated net operating loss carryforwards. It has been

determined that it is more likely than not that the deferred tax assets associated with these net

operating loss carryforwards will not be utilized. Therefore, a full valuation allowance of $2,845 has

been recorded.

As of December 31, 2005, WeightWatchers.com has net operating loss carryforwards of

approximately $19,000 for federal income tax purposes. These losses are available to reduce future

Weight Watchers International, Inc.’s consolidated taxable income and will begin to expire at varying

amounts after 2020.

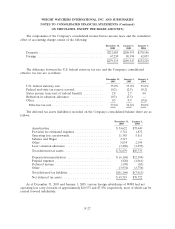

The Company’s undistributed earnings of foreign subsidiaries are not considered to be reinvested

permanently. Accordingly, the Company has recorded all taxes, after taking into account foreign tax

credits, on the undistributed earnings of foreign subsidiaries.

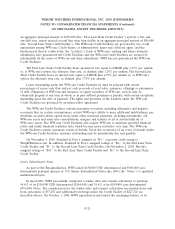

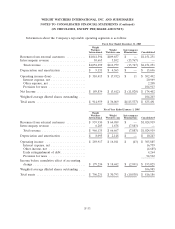

11. Related Party Transactions

Transactions with WeightWatchers.com:

WeightWatchers.com was formed on September 22, 1999 to develop and market monthly

subscription weight loss plans on the Internet. WeightWatchers.com provides these weight management

products to consumers through paid access to specified areas of its website. It also provides marketing

services to WWI.

Due to the adoption of FIN 46R, the Company’s consolidated financial statements include the

financial statements of WeightWatchers.com beginning April 3, 2004. As a result, for all periods

through and including the first quarter of 2004, WWI’s transactions with WeightWatchers.com were not

considered intercompany activities and therefore, the resulting income/(expense) has been included in

the Company’s consolidated results of operations. Beginning in the second quarter of 2004 with the

adoption of FIN 46R, all transactions with WeightWatchers.com are now considered intercompany

activities and, therefore, are eliminated in consolidation.

Therefore, the Company’s consolidated results for the year ended December 31, 2005 contain no

income/(expense) related to WWI’s activities with WeightWatchers.com since all such activity was

eliminated in consolidation. However, the Company’s consolidated results for the year ended January 1,

F-28