WeightWatchers 2005 Annual Report Download - page 93

Download and view the complete annual report

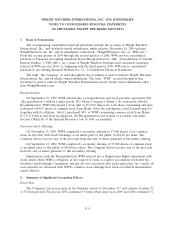

Please find page 93 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

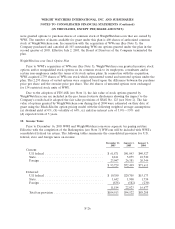

with WW.com (the ‘‘Merger’’), 1,126 shares of WW.com common stock owned by the employees of

WW.com and other parties not related to Artal for a total price of $28,383, and acquired an additional

2,759 shares of WW.com common stock, representing outstanding stock options then held by WW.com

employees, for a total price of $62,342.

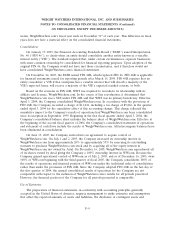

The acquisition of the 1,126 shares represented shares owned outright by the employees of

WW.com and other parties not related to Artal. This component of the transaction has been accounted

for under the provisions of Statement of Financial Accounting Standards No. 141, ‘‘Business

Combinations,’’ (‘‘FAS 141’’). The acquisition of these shares resulted in an increase to goodwill of

$26,185 and an increase to finite-lived intangible assets of $1,161, primarily customer relations and

information technology. These amounts represent the excess of the purchase price of $28,383 over the

net book value of the assets acquired plus transaction costs.

The acquisition of the 2,759 shares represented vested and unvested options owned by employees

of WW.com. Because at the time of the acquisition of these shares Artal owned approximately 47% of

WW.com and is the parent company to WWI, the acquisition of these shares is considered to be a

transaction between entities under common control, and therefore, the provisions of FAS 141 are not

applicable. Under the guidance of FASB Interpretation No. 44, ‘‘Accounting for Certain Transactions

involving Stock Compensation,’’ (‘‘FIN 44’’), and Emerging Issues Task Force Issue No. 00-23, ‘‘Issues

Related to the Accounting for Stock Compensation under APB Opinion No. 25 and FIN 44,’’ (‘‘EITF

00-23’’), the Company was required to record a compensation charge related to the 2,293 vested

options of $39,647 in the second quarter 2005. This amount represents the difference between the

purchase price per share and the exercise price per share of the vested options. The 466 unvested

options were exchanged for 134 restricted stock units of WWI, resulting in deferred compensation of

$7,214, which will be recorded as compensation expense in future periods as the restricted stock units

vest.

In connection with the acquisition of the WW.com shares, WWI also purchased and canceled all

103 outstanding WW.com options held by WWI employees for a total settlement price of $2,415. Under

the guidance of FIN 44 and EITF 00-23, the Company was required to record the full settlement price

as a compensation charge in the second quarter 2005. This charge, coupled with the aforementioned

$39,647 compensation charge recorded in connection with the vested options held by WW.com

employees, resulted in a total compensation charge of $42,062, which was recorded as a component of

selling, general and administrative expenses in the second quarter of 2005.

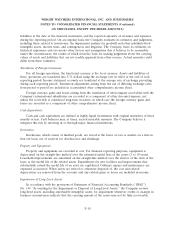

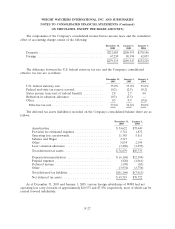

On June 13, 2005, WW.com entered into a redemption agreement with Artal (the ‘‘Redemption’’)

to purchase the 12,092 shares of WW.com currently owned by Artal. Pursuant to the Redemption on

December 16, 2005, WW.com redeemed the remaining 47% of its outstanding shares of common stock

held by Artal for the aggregate cash consideration of $304,835, the same purchase price per share as

that paid by WWI in the merger. WW.com used cash on hand of approximately $89,800 and the

proceeds from two new credit facilities (see Note 6) which totaled $215,000. In accordance with the

provisions of SFAS No. 150, ‘‘Accounting for Certain Financial Instruments with Characteristics of Both

Liabilities and Equity,’’ because at the time of the Redemption Artal owned approximately 47% of

WW.com and is the parent company of WWI, the Redemption was considered to be a transaction

between entities under common control. Therefore, the redemption was recorded as a Dividend to

Artal in the stockholders’ equity section of the balance sheet.

F-17