WeightWatchers 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash used for financing activities totaled $59.5 million. We paid $60.3 million in connection with the

tender offer and repurchase of our 13% Senior Subordinated Notes and the concurrent refinancing of

the WWI Credit Facility and repurchased $28.8 million of stock in accordance with our stock

repurchase plan that began in October 2003. These were partially offset by net proceeds of

$26.6 million from additional debt borrowings arising at the time of The WW Group acquisition at the

end of March 2003.

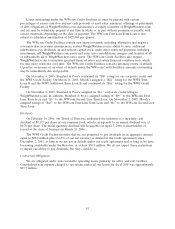

Long-Term Debt

The WWI Credit Facility consists of Term Loans and a Revolver. The WW.com Credit Facilities

consist of first and second lien term loans. As of December 31, 2005, Weight Watchers International

had debt of $531.1 million and had additional availability under its $350.0 million Revolver of

$112.2 million. As of December 31, 2005, WeightWatchers.com had debt of $215.0 million. Our total

debt outstanding was $746.1 million at December 31, 2005 and $469.1 million at January 1, 2005,

respectively.

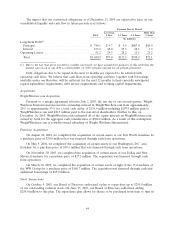

In January 2004, we refinanced the WWI Credit Facility, moving a large portion of our Term

Loans to the Revolver. This provided us with a greater degree of flexibility and the ability to more

efficiently manage cash. Under this refinancing, our Term Loans were reduced from $454.2 million to

$150.0 million and our Revolver capacity was increased from $45.0 million to $350.0 million. To

complete the refinancing, we borrowed $310.0 million under the Revolver.

In October 2004, we increased our net borrowing capacity by adding an additional Term Loan to

the existing WWI Credit Facility in the amount of $150.0 million, coterminous with the previously

existing WWI Credit Facility. These funds were initially used to reduce borrowings under our Revolver,

resulting in no increase to our net borrowing. Additionally, in October 2004, we repurchased and

retired the remaining balance of our 13% Senior Subordinated Notes.

In connection with the refinancing and retirement of debt described above, we incurred expenses

of $4.3 million in fiscal 2004.

On June 24, 2005, WWI amended certain provisions of the WWI Credit Facility to allow for the

December 16, 2005 redemption by WeightWatchers.com of its shares owned by Artal.

On December 16, 2005, WeightWatchers.com borrowed $215.0 million pursuant to two credit

facilities (the WW.com Credit Facilities), consisting of (i) a five year, senior secured first lien term loan

in an aggregate principal amount of $170.0 million and (ii) a five and one-half year, senior secured

second lien term loan facility in an aggregate principal amount of $45.0 million.

At December 31, 2005 and January 1, 2005, our debt consisted entirely of variable-rate

instruments. At January 3, 2004 fixed-rate debt constituted approximately 3.3% of our total debt. The

average interest rate on our debt was approximately 6.1%, 4.1% and 3.7% per annum at December 31,

2005, January 1, 2005, and January 3, 2004, respectively.

41