WeightWatchers 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

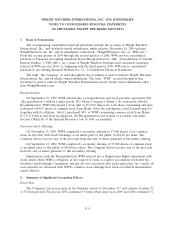

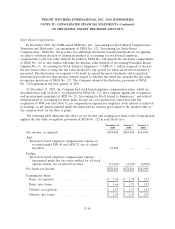

Recently Issued Accounting Standard:

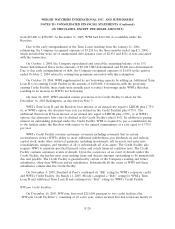

In December 2004, the Financial Accounting Standards Board issued Statement No. 123R, ‘‘Share-

Based Payment’’ (‘‘FAS 123R’’), which replaces FAS 123, ‘‘Accounting for Stock-Based Compensation’’

and supersedes Accounting Principles Board Opinion 25, ‘‘Accounting for Stock Issued to Employees.’’

FAS 123R eliminates the option of using the intrinsic value method to record compensation expense

related to stock-based awards granted to employees and instead requires companies to recognize the

cost of such awards based on their grant-date fair value over the related service period of such awards.

In April 2005, the Securities and Exchange Commission approved a new rule that amended the

effective date of FAS 123R for public companies, and the Company will now be required to, and will,

adopt this standard beginning in the first quarter of 2006.

In accordance with FAS 123R, the Company has elected to apply the modified prospective

transition method to all past awards outstanding and unvested as of the date of adoption and will

recognize the associated expense over the remaining vesting period based on the fair values previously

determined and disclosed as part of its pro-forma disclosures. The Company will not restate the results

of prior periods. Prior to the effective date of FAS 123R, the Company will continue to provide the pro

forma disclosures for past award grants as required under FAS 123. The Company believes the

incremental expense that will be recognized in accordance with FAS 123R for fiscal 2006 will be

approximately $6.0 million. However, the total expense recorded in future periods, including fiscal 2006,

will depend on several variables, including the number of stock-based awards that are granted in future

periods and the fair value of those awards.

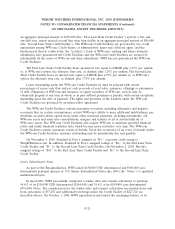

The American Jobs Creation Act of 2004 (the ‘‘AJCA’’) was enacted on October 22, 2004 and

includes a special one-time deduction of 85% of certain foreign earnings repatriated to the U.S. In

December 2004, the FASB issued FSP FAS 109-2, Accounting and Disclosure Guidance for the Foreign

Earnings Repatriation Provision within the AJCA, allowing companies additional time to evaluate the

effect of the AJCA on plans for reinvestment or repatriation of foreign earnings. This legislation did

not have a material impact on the Company’s results of operations or cash flows.

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

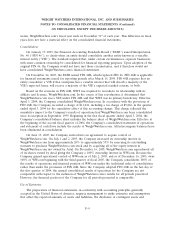

3. Acquisitions

Summary

The acquisitions of certain assets of Weight Watchers of Dallas, Inc. and Pedebud, Inc., eight of

fifteen franchises of The WW Group, Inc. and its affiliates, Weight Watchers of Fort Worth, Inc. and

F-W Family Corporation have been accounted for under the purchase method of accounting and,

accordingly, earnings have been included in the consolidated operating results of the Company since

their dates of acquisition. Details of these acquisitions are outlined below.

Pursuant to a merger agreement effective July 2, 2005, the last day of the second quarter, WWI

increased its ownership interest in WW.com from approximately 20% to approximately 53% for a total

cash outlay of $136,385, including $107,900 paid to WW.com. Further to this, on December 16, 2005,

WW.com redeemed all of the equity interests in WW.com owned by Artal for the aggregate cash

consideration of $304,835. As a result of this redemption, WW.com became a wholly-owned subsidiary

of WWI. See further discussion below for the accounting treatment of this transaction.

F-15