WeightWatchers 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December. This practice had been interrupted in fiscal 2004. As a result, fiscal 2005 included two years of

winter diet season direct marketing costs. The costs for fiscal 2005 were expensed in first quarter of fiscal

2005, and costs for fiscal 2006 were expensed in the fourth quarter of fiscal 2005. As a percentage of net

revenues, marketing expenses were 13.7% for fiscal 2005, as compared to 13.2% in the prior fiscal year.

Selling, general and administrative expenses were $169.8 million for fiscal 2005, an increase of

$72.7 million from $97.1 million for fiscal 2004. During fiscal 2005, we recorded $46.4 million of

non-recurring transaction-related expenses related to the acquisition of the additional ownership

interest in WeightWatchers.com. These transaction related expenses were primarily compensation

charges associated with the buyout of employee stock options, and expenses associated with the

relocation of WeightWatchers.com’s headquarters. In addition, there are certain recurring transaction

related expenses which will be ongoing, but declining, for the next few years. These recurring expenses

include amortization related to the acquired intangible assets with a definite life and compensation

expense for restricted stock units granted to WeightWatchers.com employees in exchange for unvested

WeightWatchers.com stock options. During fiscal 2005, we recorded $2.5 million for these expenses.

Excluding non-recurring transaction-related expenses, our selling, general and administrative

expense increased $26.3 million, or 27.1%, over the comparable period in fiscal 2004, and from 9.5% of

revenues in fiscal 2004 to 10.7% of revenues in fiscal 2005. This increase comes primarily from the

impact of strengthening our management team and higher performance bonuses for staff in most of our

regions. In addition, the consolidation of an additional quarter of WeightWatchers.com in fiscal 2005 as

compared to fiscal 2004 added $3.8 million.

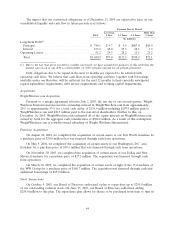

Operating income was $302.5 million for fiscal 2005. Adjusted for non-recurring transaction related

expenses, operating income for fiscal 2005 rose to $348.9 million, an increase of $43.0 million, or

14.1%, from $305.9 million for fiscal 2004. The operating income margin for fiscal 2005 was 26.3%. On

the adjusted basis, the operating income margin for fiscal 2005 was 30.3%, as compared to 29.8% in

fiscal 2004.

Net interest charges increased 25.1%, or $4.2 million, to $21.0 million for fiscal 2005, as compared

to $16.8 million in fiscal 2004. This increase was due to higher interest rates, partially offset by the

reduction in interest expense due to the redemption of the remaining $15.5 million of our 13% Senior

Subordinated Notes in October 2004, and by slightly lower average debt balances in fiscal 2005 as

compared to fiscal 2004.

For fiscal 2005, we reported other expense of $2.2 million as compared to other income of

$4.7 million for fiscal 2004. The variance of $6.9 million is primarily due to a first quarter fiscal 2004

loan repayment, made prior to our adoption of FIN 46R, from WeightWatchers.com of $4.9 million.

In fiscal 2004, $4.3 million of expenses were recorded associated with the early extinguishment of

debt as a result of the first quarter fiscal 2004 refinancing of the WWI Credit Facility, undertaken to

move a large portion of our fixed Term Loans to the Revolver, and the third quarter fiscal 2004

repurchase and retirement of the remaining $15.5 million of our 13% Senior Subordinated Notes.

These expenses included the write-off of unamortized debt issuance costs from prior refinancings and

the recognition of fees associated with these refinancing transactions.

Our effective tax rate for fiscal 2005 was 37.6%, as compared to 32.6% for fiscal 2004. We

recorded a tax benefit in the third quarter of fiscal 2004 by reversing a $5.5 million accrued tax liability

recorded as a result of the September 1999 recapitalization and stock purchase transaction with Heinz.

Additionally, WeightWatchers.com benefited throughout fiscal 2005 from the utilization of net operating

loss carryforwards, for which a full valuation allowance had previously been recorded, thus largely

eliminating its income tax expense for that year. In addition, in the fourth quarter of fiscal 2004,

WeightWatchers.com recorded a $5.0 million reversal of its deferred tax valuation allowance which

resulted in a $4.8 million tax expense benefit in that quarter.

34